I love to measure and track my progress, be it in the number of steps, amount of exercise I did in a week, etc. It helps me stay motivated to see the numbers go up and gives me a sense of progress that I made. Even if I am stuck in my professional life, knowing that I am making progress in my personal life gives me great solace. A big part of my personal life that I recently started to track is my financial health. I used to procrastinate doing this because it seemed a lot of work and honestly I thought I would not like what I saw. But this year, I bit the bullet and decided to put things on paper to track my financial progress every year. One measure of financial health is net worth and I studied how to calculate this for a household. I will share with you what I learnt through my conversations with Wealth Wise Owl.

Here are a few YouTube videos from where I got my information

Net Worth By Age in 2024: How Do You Stack Up?

How Much Money You Actually Should Have Saved By Age (2024)

Use the links below to jump to a specific section you are interested in

Net Worth calculation and Financial Assets list

The 20s decade: Net Worth and Financial Assets

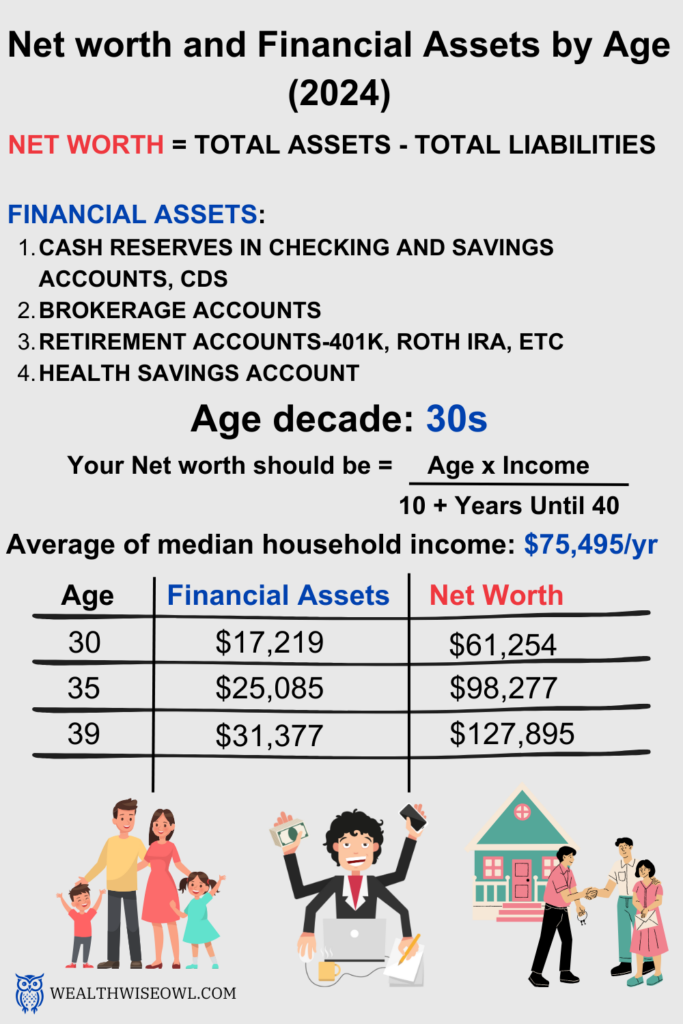

The 30s decade: Net Worth and Financial Assets

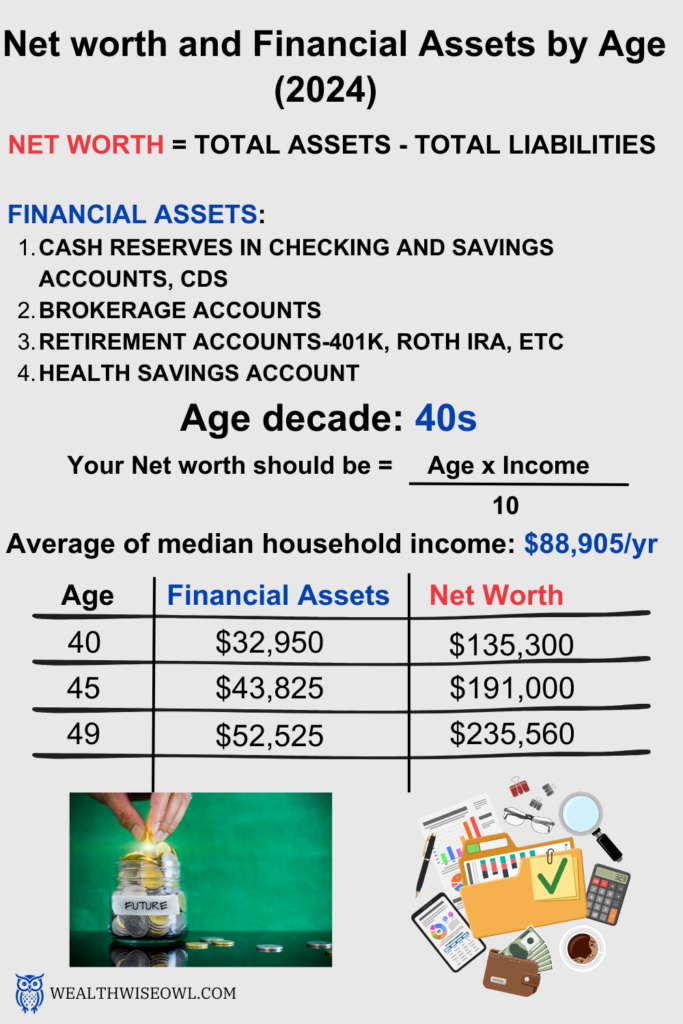

The 40s decade: Net Worth and Financial Assets

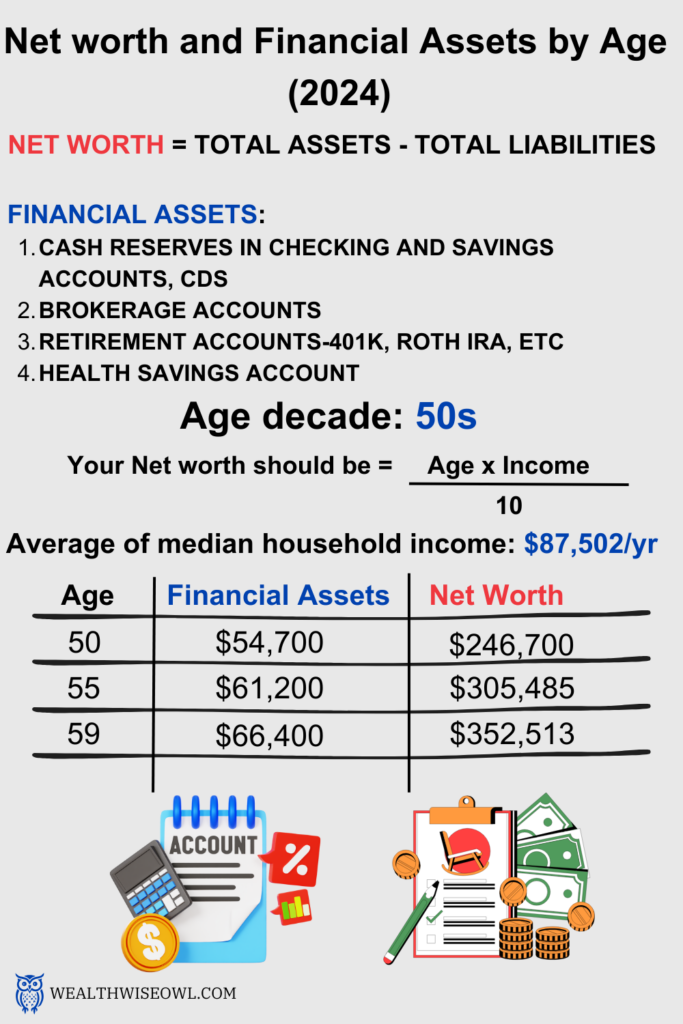

The 50s decade: Net Worth and Financial Assets

Conversations with Wealth Wise Owl

Good morning my friend! Are you excited for this year to end and start a new year?

Hellooo! Yes I am super excited to start a new year. Although it changes very little in my day to day, but I like the buzz it creates everywhere else. There is suddenly a lot of energy and hope people have to make new resolutions and plans, which is good to see. What are your plans to close out this year and start another one?

That is so true about people becoming energized to start things afresh and hit reset on their lives. I too plan to make a list of things that I want to achieve in the coming year and to close out this year I am creating a list of what I accomplished this year. Lots of lists but I realize that I can feel proud of what I achieved this year and it will give me motivation to strive for more next year.

I am so glad you are doing that because it is not just important to keep making plans for the future but to also take stock of what you have already achieved.

Exactly! This year I have decided to track my financial health, which I got inspired from all the conversations I have had with you this year. I am simultaneously excited and afraid to know how I am doing financially and is it better or worse than others. Do you have any suggestions on how I can go about this?

I definitely have one thing that you can start with, which is calculating your net worth. It is simply a difference between what you own and what you owe. The higher this number is, the better you are in terms of financial health. There is a lot of data out there on the net worth of people based on their age, salaries, etc based on surveys by government agencies. So, you can also compare where you stand based on your net worth. Does that sound like something you would like to do?

For sure! I know businesses have a balance sheet they maintain to track the assets and liabilities, so this is very similar to that but on a smaller scale. I am also glad that there is data to compare my net worth with the general population. No health check is complete without comparing against guidelines and I feel this data would serve as a gauge to measure my financial health against.

I like how you drew those analogies with business balance sheet and guidelines for health. We can get started with what makes up the assets and liabilities for a household.

https://www.nerdwallet.com/article/finance/net-worth-calculator

Assets: These are things that you own and can get some value if you decide to sell it. For a typical household some of the common assets are:

- Cash

- Checking accounts

- Saving accounts

- CDs, Money market funds or other fixed income funds

- Stocks or bonds in Brokerage accounts

- Stocks or bonds in Retirement accounts like 401k, IRA, etc.

- Jewelry

- Collectibles

- Real estate (current market value of your house)

- Cars (current market value of your car)

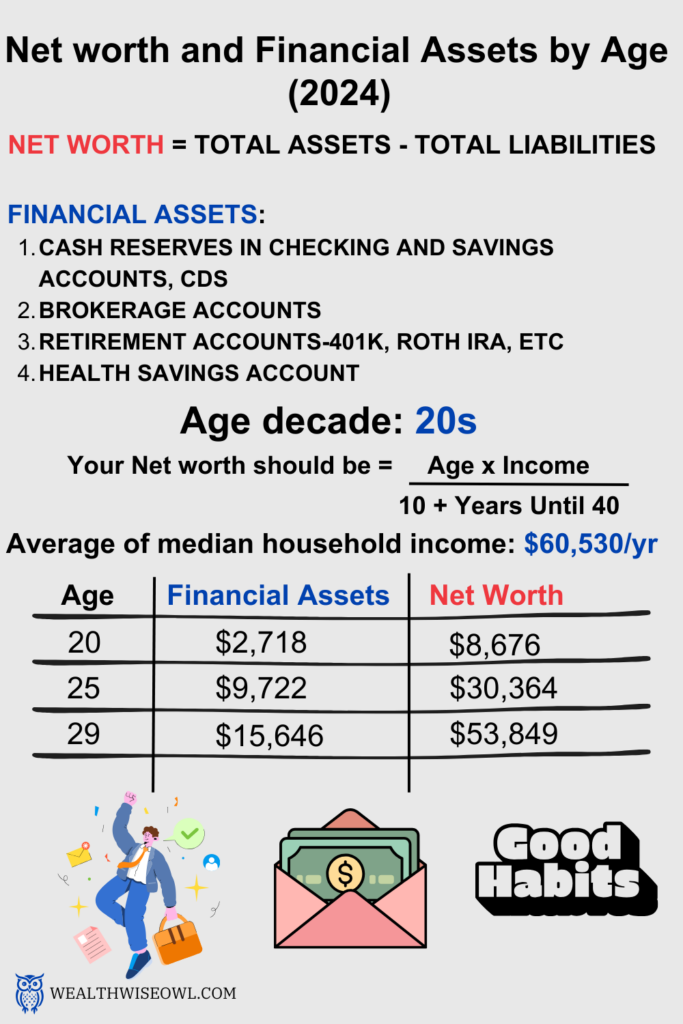

Financial assets: Within the above list, you can make a sub list of financial assets i.e. assets that can be sold for cash within a day or two without a significant loss in value. These assets would be the cash you have, money in.

- Checking/saving accounts

- CDs

- Money market funds

- Stocks or bonds in brokerage accounts

It is important that the liquid assets are high because this is what you can use for emergencies or any other situation where you need cash immediately. Having non-liquid assets like a house is good but it cannot help you pay your immediate bills without worsening your debt situation.

https://www.nerdwallet.com/article/finance/liquid-net-worth

Liabilities: These are things that you owe that is need to pay someone or some institution. They would include any loans you may have like a

- House mortgage

- Car loan

- Student loans

- Credit card debt

Once you list all these items and their dollar amount, you can calculate your total assets and liabilities. This list of assets and liabilities may have other items based on your personal situation. Net worth is simply your

Net Worth = Total Assets – Total Liabilities

If you want to know what your net worth should be, you can use the formulas below (credit to the Money Guy show for this information)

Net worth = Age x Income / (10 + Years until 40)

So, say if you are 25 years old and earning $50,000/yr then your net worth should be

Net worth at 25 = 25 x $50,000/(10+15) = $50,000

Okay, the list you shared is really helpful to understand what my assets and liabilities are. I can start with making this list for my current situation and will track it every year to see if I am making progress.

Yes, you should definitely do that and give yourself a pat on your back if the Net worth keeps increasing. There might be phases in life where it might dip due to major life events like having a kid or buying a house but always look to keep improving it year over year. A good way to check how you are doing in terms of net worth is to compare against the median net worth data. (Federal Reserve Survey of Consumer Finances). Let us go over the different decades in one’s life and see what to focus on and the median numbers for financial assets and net worth.

Let us begin with the 20s, where you have probably just joined the workforce after finishing your education.

- This is the decade where you need to start making good financial habits i.e spend less than you earn. It will really help if you follow the order of investing [check out this blog to know the order of investing for your paycheck] to set up for success.

- You may not have a big paycheck since you are starting out but remember that time is on your side. Time is your best friend at this stage since even small amounts that you invest can grow big with compounding growth.

Based on the data, the average of median household income in 20s is $60,530/yr. You can see from the financial assets and net worth at different stages in 20s that everybody starts small and that is okay. It is what you make of it that will determine your future.

| Age | Financial Assets | Net worth |

| 20 | $2,718 | $8,676 |

| 25 | $9,722 | $30,364 |

| 29 | $15,646 | $53,849 |

This is really helpful and something that I can start doing is to stick to the order of investing that we talked about. I probably have numbers close to the median right now so it makes be feel that I am doing alright. What does the 30s have in store?

30s are called the messy middle because this is where life starts to get real for most people. You may get married, start a family, buy a house, etc. It is the time where you are both short on money and short on time because life pulls you in all the different directions. It is therefore important that you do not go off the rails completely here.

- Try to make the best of the situation and spend only on things that are valuable to you, not what is trending among other people of your age.

- It is good to start hitting the 25% savings rate target if you can because the sooner you begin, the less you will need to work till retirement.

- Above everything else, if you have dependents, make sure to have an emergency fund to cover your family for the unexpected.

If we look at the survey data, then the average of median household income in this decade is $75,495/yr.

| Age | Financial Assets | Net worth |

| 30 | $17,219 | $61,254 |

| 35 | $25,085 | $98,277 |

| 39 | $31,377 | $127,895 |

This makes a lot of sense. I can already see my responsibilities going up as I look to settle down and start a family. The expenses go through the roof, be it planning for a wedding or buying a house. As you said, I will try to stick to the order of investing and save as much as I can.

That’s the spirit! Believe me this will give you a running start towards your retirement and makes your 40s less stressful. 40s is when you need to really start thinking about what your retirement would look like.

- You need to figure out how much you will need during retirement by using different tools or even talking to a financial planner. [Check out this blog on calculating how much you will need during retirement]

- Once you know this number, you can start saving money in the right accounts and get the right balance between the three types of retirement accounts – tax-deferred, tax-free and taxable. [Check out this blog to know more about the retirement accounts you need to have].

- The 25% savings rate target will become a need to have rather than good to have at this stage to help save for retirement. If you have not had enough savings in your 20s and 30s, then this is the time you have to start making up for that.

The average median household income in the 40s is $88,905/yr.

| Age | Financial Assets | Net worth |

| 40 | $32,950 | $135,300 |

| 45 | $43,825 | $191,000 |

| 49 | $52,525 | $235,560 |

I can imagine life will be so much different than what is now for me. I am glad there is nothing drastic that would need to be done as long as I am doing the basics which we talked about. Okay now what will 50s look like?

50s is when retirement will feel right around the corner. Now, you can be in a strong position to reap the rewards of all the work you have been doing the past few decades.

- You now need to know what your retirement number is i.e. how much you need to save in your retirement accounts to have the lifestyle you want during retirement. [Check out this blog to calculate your retirement number]

- It is good to talk to a financial planner or advisor to make sure you have covered all the bases. They will try to make sure that in all the different scenarios that life may throw at you, you will come out winning in majority of them. This is important because you do not want to be worrying about not having enough once your major source of income goes away.

The average median household income for someone in their 50s in $87,502/yr.

| Age | Financial Assets | Net worth |

| 50 | $54,700 | $246,700 |

| 55 | $61,200 | $305,485 |

| 59 | $66,400 | $352,513 |

Yes, I am definitely going to seek some professional advice to make sure my retirement portfolio is robust and there are no blind spots. I want to know how much exactly I can spend so that I am not staring at a zero account balance and need to consider going back to work!

I hope the same for you and I am confident that you will be comfortable considering how diligently you are following all the financial advice I give!

One common theme you would have noticed in the data is that the net worth is substantially higher than the financial assets. The main reason for this is that people have a lot of equity stored in their houses. It is good that they have all that equity but it does not help when they need liquidity to spend on different things. This where your financial assets are going to help you and therefore you need to make sure that these are also substantial to take care of your retirement needs..

I will keep that in mind! Great talk as always and appreciate your time. If I do not see you before the end of the year, I would like to wish you a great holiday season! See you soon my friend!