Do you ever dream of not working and still getting paid? One way to achieve that is to retire with enough savings in your retirement accounts. This is not an attractive option but it’s the one that will guarantee peace of mind about your retirement income. After working for nearly 5 years now, I have recently gotten to know enough through my conversation with a Wealth Wise Owl, and I will share that knowledge with you.

Before diving into what our conversation was like, I just wanted to share some background information. 401k is one of the several retirement account options that you can use to save for retirement. The name, 401(k), was born out of the US tax code “401” and subsection “k” – clearly someone did not want to be creative here! This was introduced to supplement the pension plan and was an incentive for people to take retirement planning in their control. It is an employer-sponsored plan, so if you are self-employed or your employer does not have a 401k plan, fear not there are options which I will cover in a separate blog.

If you want to find specific answers you can use these links to go to the right section:

- Contribution match = free money

- Contribution limits

- Tax savings on 401k

- Roth 401k vs Traditional 401k

- Should I contribute to Traditional 401k or Roth 401k

Conversations with the Wealth Wise Owl

Hey Wealth Wise Owl, I’m here to understand the basics of 401(k). I heard it’s an important step towards retirement. Retirement is not going to happen anytime soon for me, but they say it’s never too early to start planning.

Hi Sourabh, good to see you! I’m glad to discuss about 401(k) but I won’t say you’re too far from retirement, I see some grey hair!

Haha, you’re indeed wise!

First of all, should I even care what a 401k is and spend time learning about it?

You have started with the simplest but the most important question, which is good. The short answer is, Yes! There are multiple ways to save for your retirement but 401k offers a tax-advantaged way of saving, which over your human life could mean hundreds of thousands of dollars of taxes that you will not have to pay legally. Paying taxes is the no. 1 hated thing in your world, so imagine the joy of getting respite.

I am sold on NOT having to pay a lot in taxes and want to learn more. Do I need to open this 401k account with a bank?

No, this is something you do not need to do if it is provided to you by your employer and they offer a 401k retirement plan. This plan is called 457 if you work for the government and 403(b), if you work for private nonprofits or public schools. The employer partners with brokerage firms like Fidelity, Charles Schwab, Vanguard, etc. that can handle retirement plans. You should talk to your HR if you are eligible for 401k because some companies set criteria for employees to qualify for these retirement plans. Be aware that there are two main types of 401k account – Traditional 401k and Roth 401k. We can first talk about the 401k account in general, then move to Traditional 401k and end with Roth 401k. There is a lot to talk about, so let me get comfortable on this tree branch.

Okay, I found from my HR that there is a 401k plan they offer and by default, I was already enrolled in the plan with a 3% contribution. I was happy that I had started saving for retirement, without my knowledge, and it is a good day when you know you have more money saved than you thought! So, what does this percentage contribution mean I heard something about company match, what is that about?

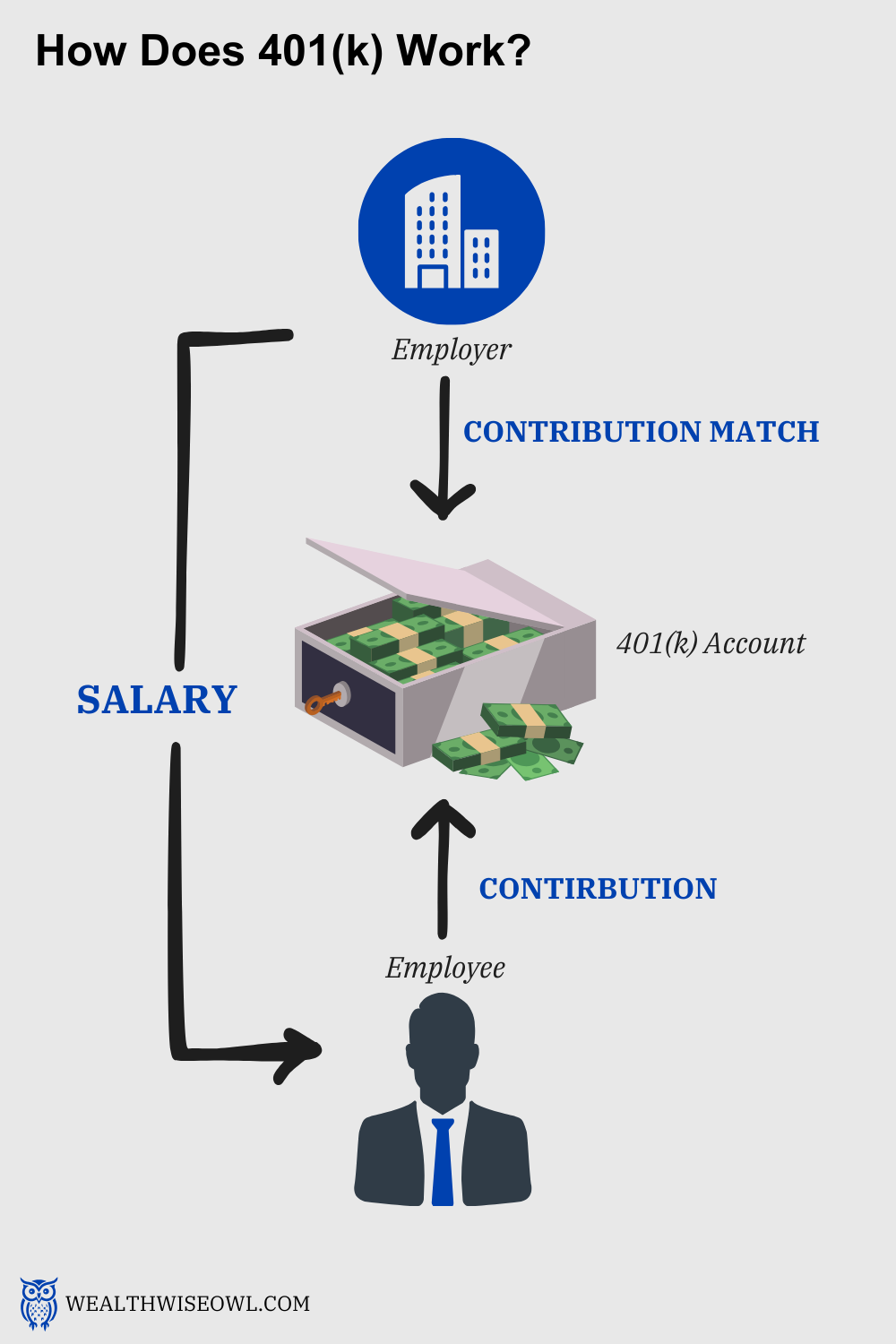

That’s excellent, somebody was already being wise for you and got you a head start on saving for retirement. The percentage contribution is basically a percentage of your gross or pre-tax income that is sent to your 401k account. So, let’s say for easy math that your gross income is $100,000/yr, then 3% of that is $3000, which will be transferred to your 401k account.

Now, you will love what a contribution match is, so hold on to your hat. A contribution match is money that the employer contributes to your 401k account for free. This is to incentivize you to contribute towards retirement and also tempt you to stay longer with them. If we take the example forward and if your employer was matching a 100% of your contribution up to 4%, then you would have got an additional $3000/yr in your account from the employer. If that is not free money then I don’t know what is! I would suggest you increase your contribution to 4%, so that you can get the full match of $4000/yr from your employer. Unless you are feeling too rich and want to give up on an additional $1000/yr in savings.

Wow, free money towards retirement! I am not giving up on that for sure and will waste no time in increasing my contribution to get the full match. I could not have imagined this is possible and now that I know this, I am kicking myself for not having asked about this earlier. Better late than never, right? Also, you had talked about tax savings, where and how am I getting that?

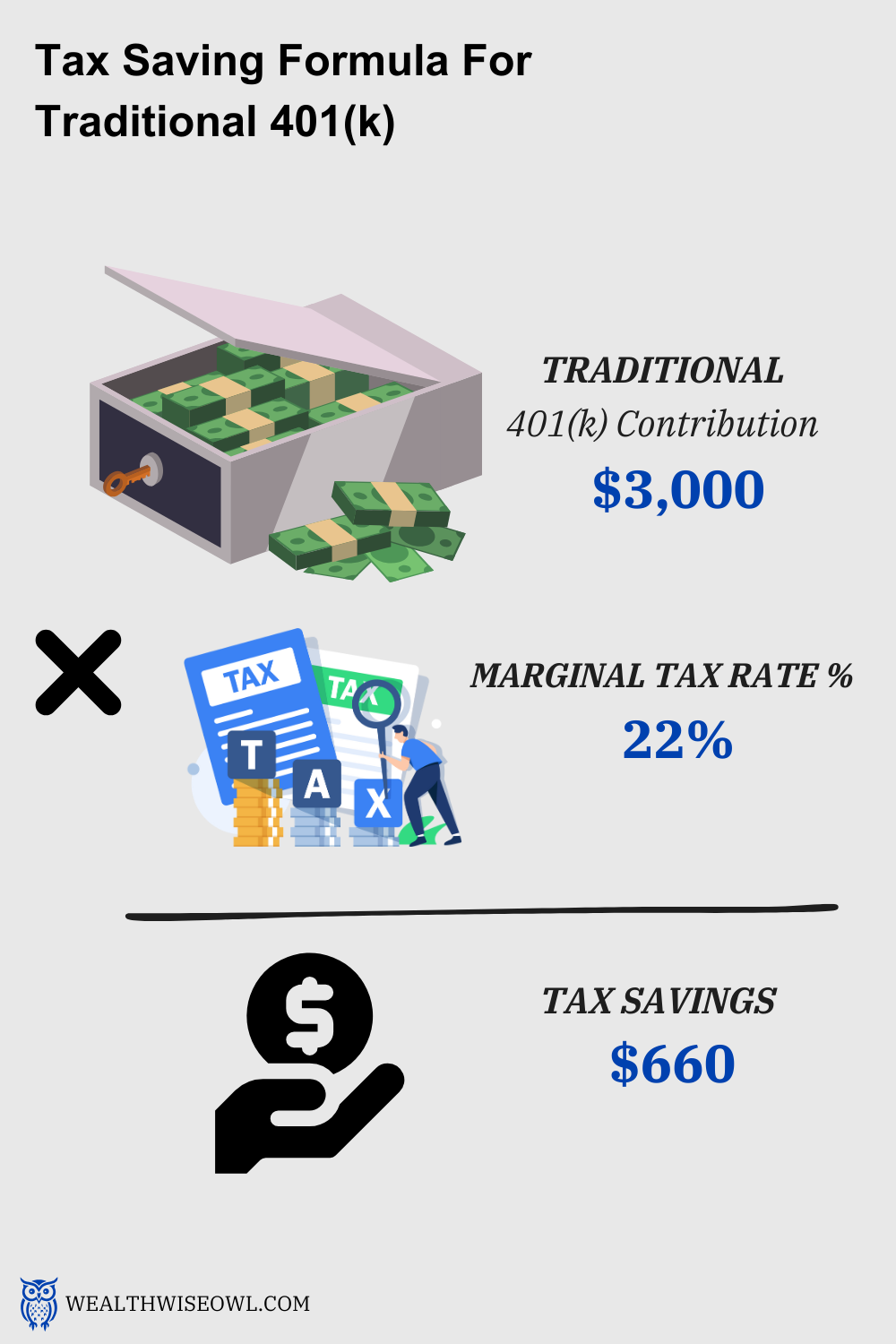

The money that you contribute towards 401k reduces your taxable income, so you end up paying taxes on a smaller amount and that is where you save on taxes. So, if you were contributing 3% of your income towards 401k, your taxable income reduces by $3000. In this example, since your marginal tax bracket for 2024 will be 22%, you will save 22% of $3000 in taxes which is $660.

[See what your marginal tax bracket is]

The thing to note here is that since your taxable income is reducing, this also means your take-home pay will reduce. Beware of this when you are budgeting and want to factor in the effect of 401k contributions.

[See the effect of contributions to your 401k on your tax savings and money from employer match]

I like the sound of this 401k account, it can save $1660 more by contribution match and tax savings. Even if the hypothetical example does not apply to me, I am happy for this hypothetical individual! So, now that I know how good this is, can I contribute how much ever I want?

I like how you have gone from “If 401k is even worth my time” to “Tell me what is the maximum I can contribute to it”.

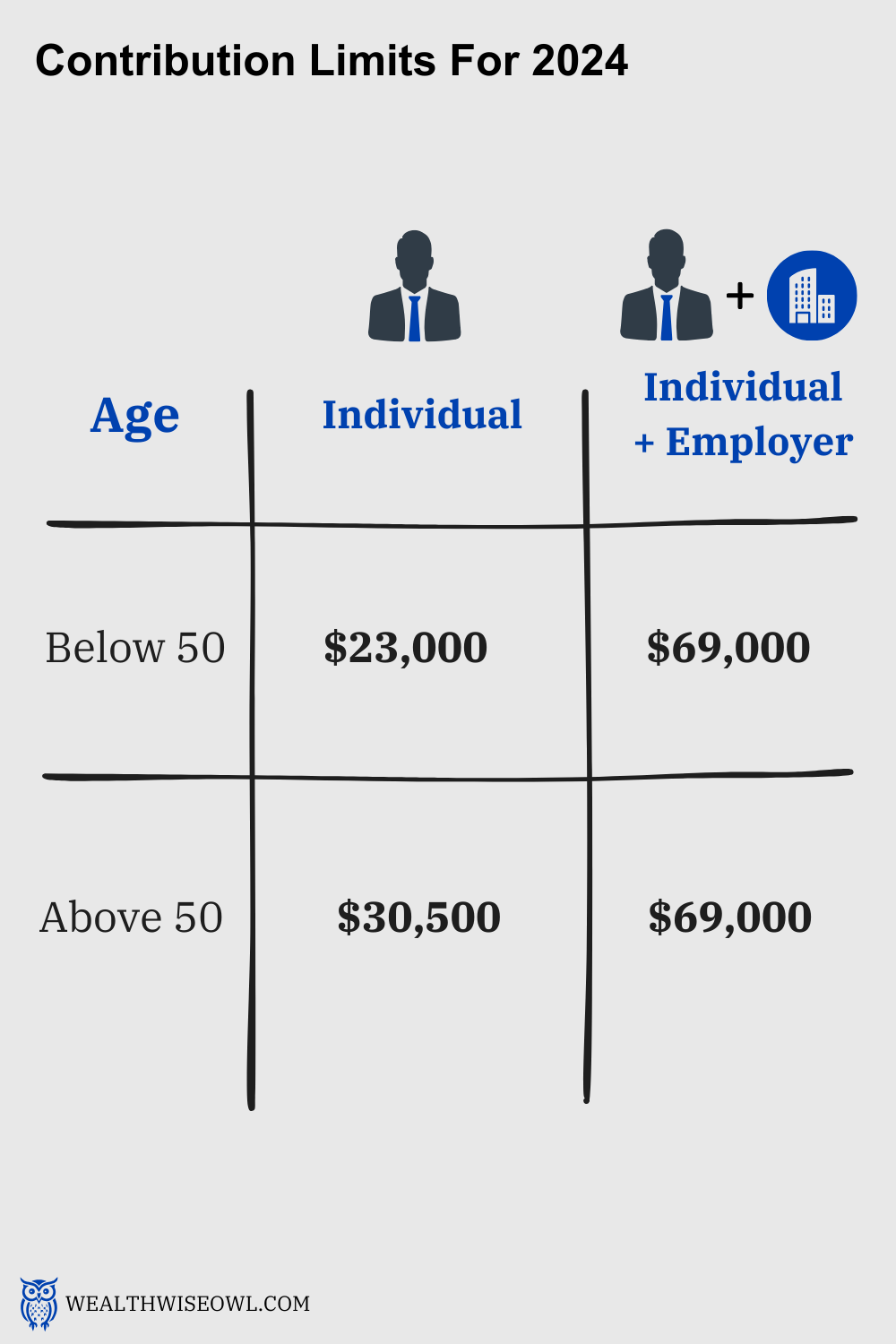

IRS has a maximum limit on how much you can contribute which changes every year and also depends on your age. So, if you are below 50 years old, the contribution limit is $23,000 in 2024 and if you are 50 or above then that limit is $30,500. This does not include the contributions from your employer, so basically, the $3000 that the employer was contributing for the match in the example is not part of the $23,000 limit. However, there is a limit on how much the employer can contribute, and the total that can be contributed to your 401k, including the employer match, is $69,000 in 2024. You can find information on these limits on the IRS website.

One thing to note is to not exceed these contribution limits since it will result in a 10% penalty. If you do make excess contributions then have them returned to you, including any earnings from them, before the tax filing deadline, and then fill out a 1099-R form to report the excess contributions. I am wise in finance but not a tax expert so consult one if you find yourself in this situation.

Glad you told me about the limits because I would have gone full throttle in putting money into my 401k. Wait, but can I withdraw money from my 401k account whenever I want?

No, this is your retirement savings account so you can only start withdrawing from this account when you reach the retirement age of 59.5 years. Any withdrawal before that you will need to pay a 10% penalty on the withdrawal amount along with taxes.

There are situations where you can make early withdrawals without incurring the penalty, it’s called ‘Hardship Withdrawal’. These situations are mostly emergencies, natural disasters, health conditions, etc. IRS has a list of all these scenarios and also situations that qualify for hardship withdrawal. I hope you never find yourself in one of these situations but is good information to have for backup funds.

This is good information, I will never make withdrawals from this account unless I am forced to. The word penalty is enough to scare me into not touching this till retirement.

Now that I know I need to contribute to this account every year and not withdraw it till retirement, what exactly is happening to the money in this account? Please tell me it does not just sit there collecting dust!

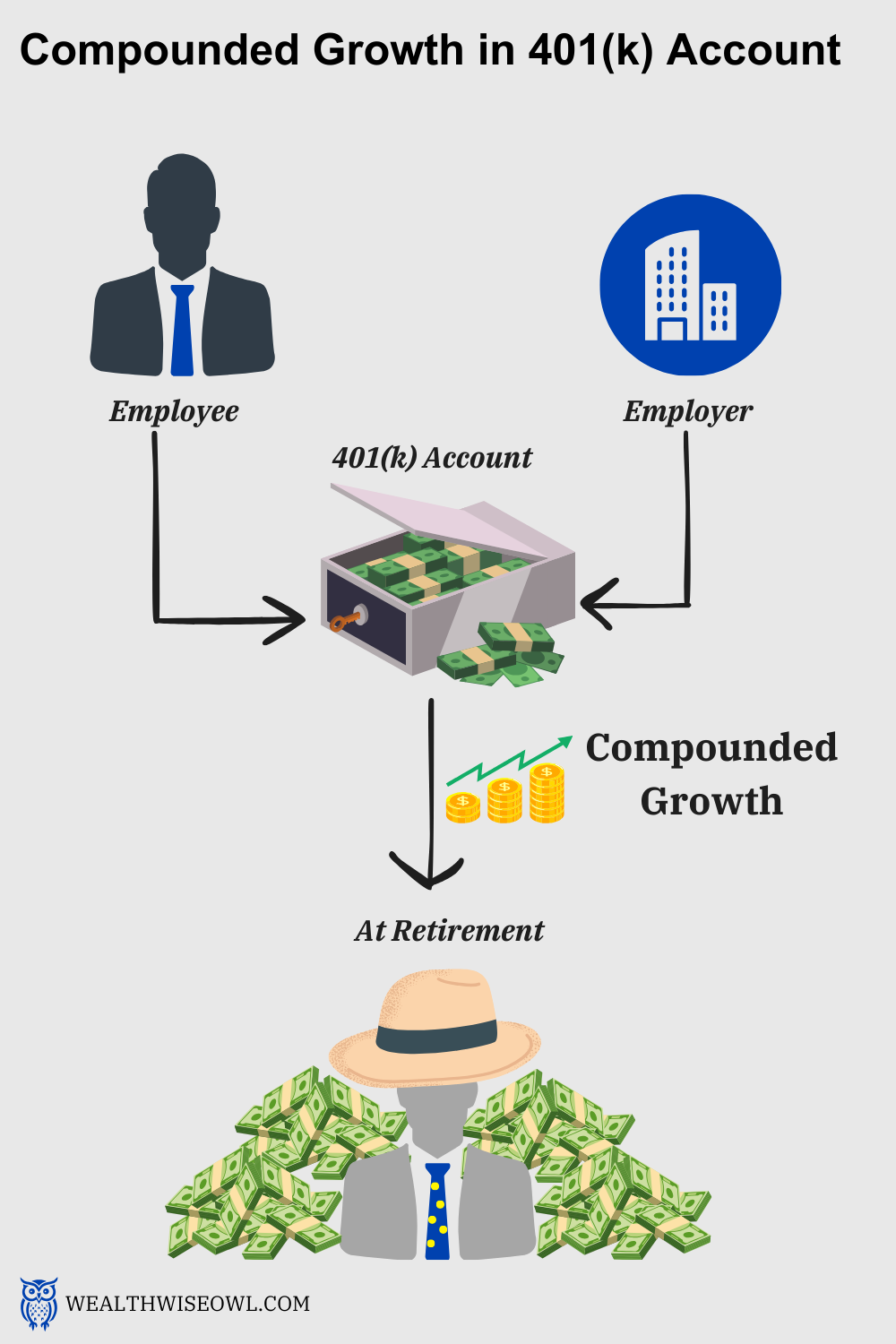

The money in that account grows and that too in a compounded growth! Albert Einstein called compounding the world’s eighth wonder, so imagine how great this growth would be for your retirement savings.

The way you get this growth is by investing your money in different funds that are available in your 401k account. The type of funds you can invest in will vary based on which institution handles your 401k but some common types are target date funds, large-cap mutual funds, emerging market mutual funds, bonds, etc. We can talk about how to select which funds to invest in later, but if you want to get started, you can go for the target date funds. The names of these funds include a year, so just look for the year in which you would retire and select that fund as your choice of investment. You can also change your investment selections later on but check with your provider on how many changes you are allowed to make in a year.

The typical rate of return expected is between 5-8% based on your investments. This number seems small but can you imagine how much this will grow if compounded over 10-20 years till you retire? Let’s crunch some numbers – for a 3% contribution that you have now with 100% employer match till 4%, the total contribution to the 401k account is $6000 ($3000 from you + $3000 from your employer). Let’s assume that you keep contributing the same amount every year till you retire in 35 years and a conservative rate of growth of 8% every year. The total amount you will have in the account when you retire will be $ 1.16 Million. Please close your mouth lest a fly get in! Yes, a small percentage contribution every year can make you a millionaire by the time you retire.

Okay, I am still wrapping my head around becoming a millionaire. I did not expect this word to come up when we started our conversation on 401k. Now I am super pumped but wait I also see there is something called a Roth 401k, now what is this new mystery account?

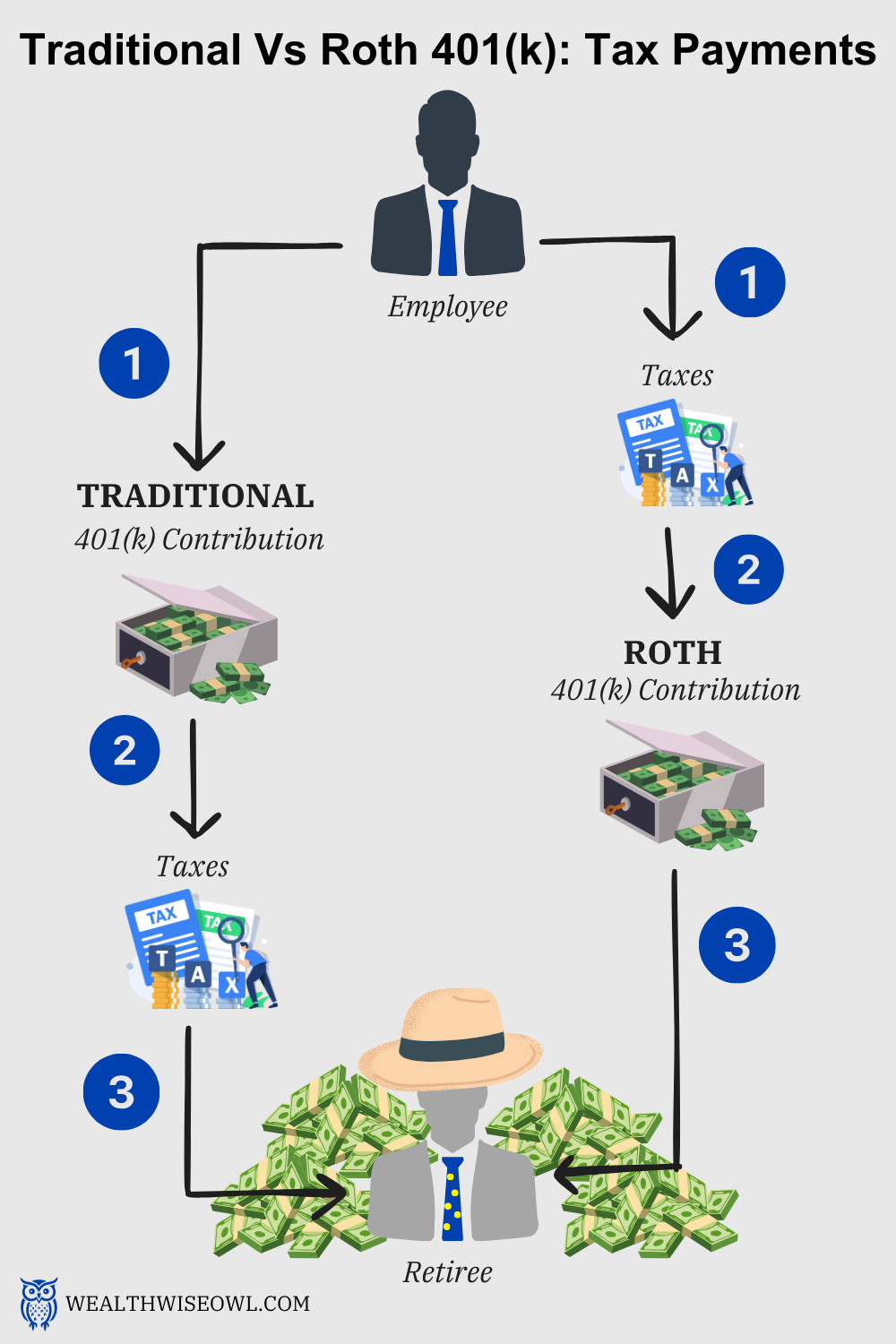

Glad you brought that up. Roth 401k is another type of 401k account. The type of 401(k) we have been talking about so far is called a traditional 401k. You can contribute to either or both of these accounts but it is important to understand how they differ. The main difference between these accounts is at what stage taxes are applied.

For the traditional 401k, as we discussed before, you do not pay taxes now but you pay them when you withdraw money from this account, during your retirement. The taxes you pay will depend on what tax bracket your withdrawal falls under. Say you retire at 60 and withdraw $40,000 in your first year, if the 2024 tax bracket holds even then, which is highly unlikely, your marginal tax rate would be 12%.

For the Roth 401k, you contribute money after you have paid taxes on it. You should check if your employer offers this type of account because it is not that common. Note that even if you select to contribute to a Roth 401k, the employer match is always contributed towards the traditional 401k. Unlike the traditional 401k, contribution to this account does not reduce your taxable income. However, since you have already paid taxes on it, any withdrawal you make from this account after retirement is tax-free.

Another condition that needs to be met for withdrawing tax & penalty-free, besides reaching retirement age, is that the account needs to be at least 5 years old. Isn’t that great? Pay taxes now and worry about them never! A great benefit is that you can withdraw the money contributed to this account tax-free anytime. Still, any earnings that accrue from investing your contributions will be taxed and will incur a penalty, if any, if the other two conditions (59.5 years and 5 years old account) are not met.

I know this is a lot of information with a lot of rules but if you want to remember the key points for the two accounts, the following picture will help. I know in the human world a picture is worth 1000 words, which makes me question why do you even use words!

The picture definitely helps and I can put this up somewhere when I want to remember what is what and believe me I will forget soon! So, now that I know there is an option to contribute to either or both traditional and Roth 401k, how do I decide where to contribute?

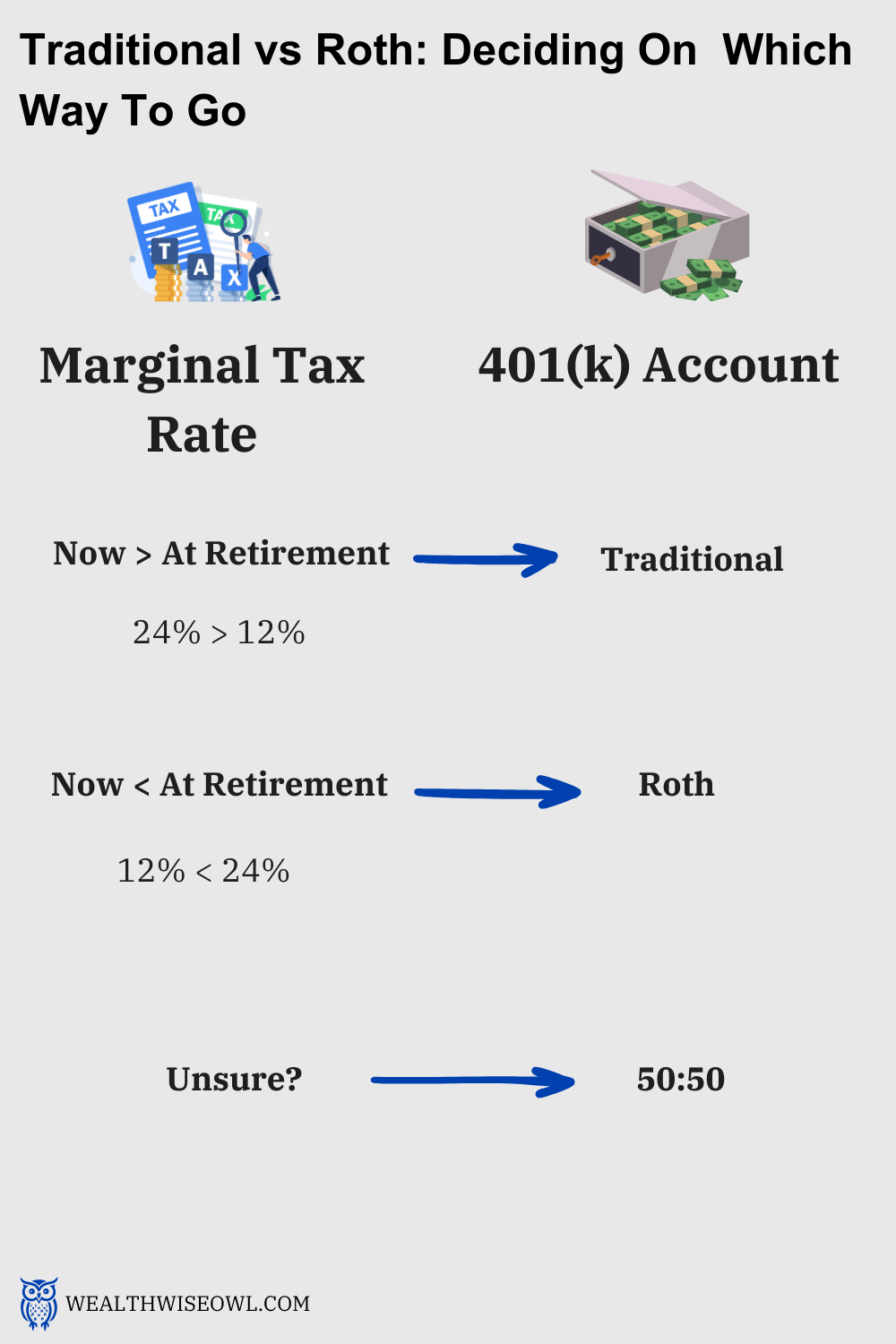

The simple thumb rule is, that if you think you will be in a higher tax bracket when you retire compared to now, you should contribute to a Roth IRA.

However, if your current tax bracket is high and you think you will have a lower tax bracket when you retire, then contribute to a Traditional IRA.

Unless you have a crystal ball it is impossible to predict what tax bracket you will end up in so it is wise to split your contributions 50-50 to both of these accounts.

It was great learning about 401(k) as a beginner! Thank you so much Wealth Wise Owl, I look forward to having more conversations with you and learning about personal finance!

[…] Read The Detailed Post Here […]