Most of us start by renting a place and then come across the dilemma of whether to buy a house or continue renting. The decision to buy a house is never straight forward and has a lot of aspects to it. If you ask anyone for advice or try to find answers on the internet, it is never a simple yes or no, at least from sources that are reliable. I found a simple rule while looking into this question that can give some guidance on how to make the decision. It basically looks at the money that you will not get back in these two options and whichever comes out to be lower wins. Again, this is not a fool-proof rule and has its set of limitations but it provides us numbers to evaluate rather than subjective opinion. Please check out these YouTube videos that I looked into for more information.

Renting vs. Buying a Home: The 8.71% Rule

Renting vs. Buying a Home: The 5% Rule

Let us learn from Wealth Wise Owl about this rule. If you would like to jump to specific type of non-recoverable costs involved in housing, use the links below:

3. Cost of capital – Opportunity costs and Debt costs

Conversations with Wealth Wise Owl

Hellooo my old friend, a very chilly good morning to you! How can you sit so comfortably up there?

Hi good to see you! You seem to be nicely layered for the weather. I have my own natural layering of feathers that keeps me warm!

Good for you. I feel jealous that you do not have to spend time wearing all these clothes and then again remove them back inside. Anyways, I really liked the conversation we had about how much house I can afford [check out this blog to learn more] but now I have a question about how should I compare the option of buying a house against renting?

That is indeed a good question! Even if you find a house that you can afford, it may or may not be a better financial decision than continuing to rent. So, if you want to strictly look at buying vs renting from a financial point of view there are some easy back of the envelope calculations you can do.

Yes, that would be amazing! I would love to understand the decision to buy a house as objectively as possible and putting some numbers is the best way to do that. So, where do we start?

Okay, first let me tell you how we are comparing the two options and then we can dive into the numbers. We always say that renting is like throwing away money because we don’t get it back or it does not build any equity. However, the money we pay towards mortgage goes into building equity and is always better. But we forget that the entire mortgage payment does not go towards equity. There is a lot of it that goes towards interest in the initial years, there are property taxes and insurance too that you don’t get back or build any equity in the house. So, the best way to compare renting and housing is to understand the amount of money we are “throwing away” or the true cost of each option.

Okay, that makes sense. We are trying to do an apples to apples comparison here by analyzing the same factor in both cases i.e. money spent in each option that we do not get back. For renting, I think the money we lose is the amount we need to pay towards rent and any renters insurance, if needed. But how do we calculate this for a house mortgage?

You are absolutely right about the housing costs of renting, the monthly cost is equal to the monthly rent plus any renters insurance that you might have to pay. Calculating how much you pay and not get back if you are paying mortgage for a house is not straightforward and that is what we will break down today. There are three types of costs of owning a home:

1. Property taxes

2. Maintenance cost

3. Cost of capital – Opportunity cost and Debt cost

Yes, I remember talking about the first two costs with you when you explained about everything that goes into a house affordability calculation. [check out this blog to learn more] But a refresher would be good. The cost of capital is entirely new for me and am excited to learn more about that.

Great, let us then first look at property taxes and maintenance costs since you already have some idea about it.

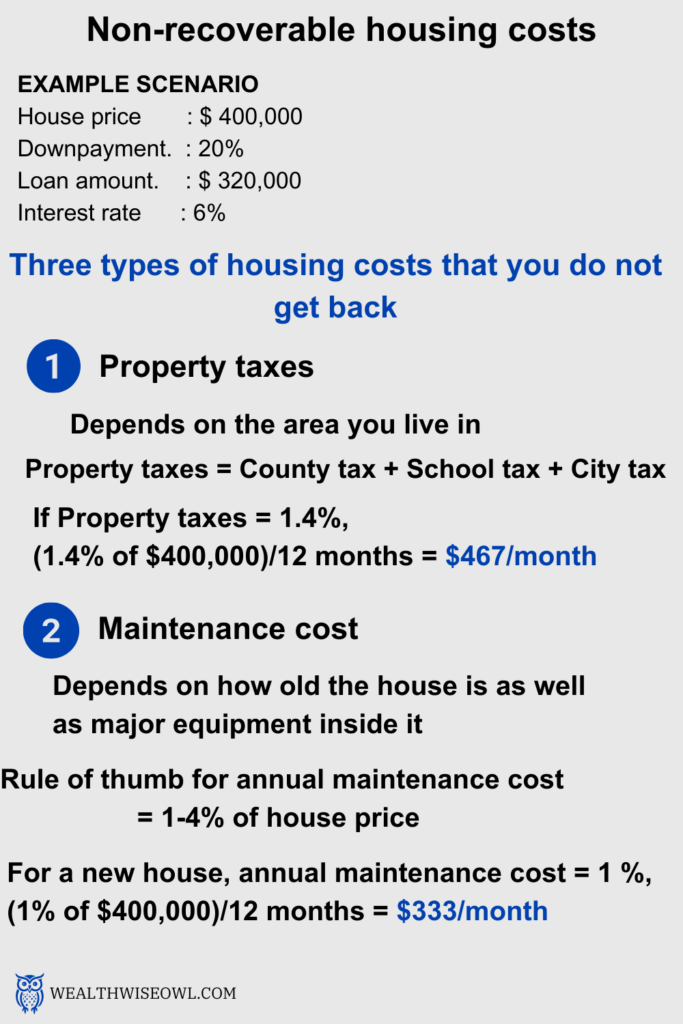

1. Property taxes – These are taxes that are based on the area you live in and this data can be found online or at your local agency. [For more details on property taxes check this blog] These taxes are a sum of the school, district and city taxes. They are reported as a percentage, so if the property taxes in your area are 1% then the amount you need to pay is 1% of your house value that year. Based on the tax percentage and house value, the amount of property taxes can vary year to year.

2. Maintenance costs – When you own a home, you are responsible for everything related to it. If the roof starts to leak or the plumbing gets damaged, you need to pay for its repairs. These costs are often not taken into account while buying a home and can be an unpleasant surprise to the budget if and when calamity strikes. It is hard to predict when things would break and how much it would cost but a common thumb rule is to assume 1% of the house value as maintenance cost every year. If you have an older house which needs frequent repairs then this percentage can be higher. [Check this blog for more details on maintenance costs]

Makes sense. These are the annual costs that one would have to pay for owning the house and which does not exist for renters. Now, what is the cost of capital?

Cost of capital has two parts to it, one is related to the downpayment for the house and the second is the interest component of mortgage payment.

I) Downpayment: This is a lump sum amount paid on the closing day. It goes towards the equity of the house but if you had not bought the house, that money could have been invested in stocks/bonds. Therefore, there is an opportunity cost of putting all that money towards downpayment versus investing in other assets. To compute the opportunity cost we need to compare the rate of return from residential real estate against stocks/bonds. The average rate of growth for real estate in the US is between 4-8% whereas for stocks, if we look at S&P 500 index for market returns, the average is about 10%. Therefore, stocks have outperformed real estate investments by 2-6%.

This 2-6% rate of return every year is what we lose on the money we pay towards downpayment.

Some resources that compare the rate of return on housing/real estate against stocks and other assets:

II) Mortgage payment: There is an interest component to the mortgage payment that you do not get back. The amount of interest depends on the interest rate for the mortgage which fluctuates based on the economy. Also, the amount of interest paid every year varies because these loans follow the amortization schedule. In the initial years of the loan, the majority of the mortgage payment goes towards the interest and it is only later on that a significant amount starts going towards paying down the principal of the loan. For simplicity of calculations and to make a conservative estimate, we can assume that a fixed amount is paid every year in interest. For example, if the interest rate on the mortgage is 6%, then conservatively 6% of the loan amount is the interest paid every year.

I think I understand this. Cost of capital is the sum of opportunity cost of using the money for downpayment and interest paid on the loan. These are also the costs we would not have incurred while renting, so makes sense to include them with property taxes and maintenance costs.

Absolutely right! Now that we know all the costs of owning a house that cannot be recovered, we can compare these with the renting costs. To do this let us take an example:

Let’s say we want to decide if buying a $400,000 house is better than renting. We can assume that the

Downpayment = 20% of house value

Interest rate on mortgage = 6% of loan amount

Property Taxes = 1.4% of house value

Maintenance cost = 1% of house value

Now, let us calculate the three types of costs in housing that we talked about.

1. Property taxes = 1.4% of house value

2. Maintenance cost = 1% of house value

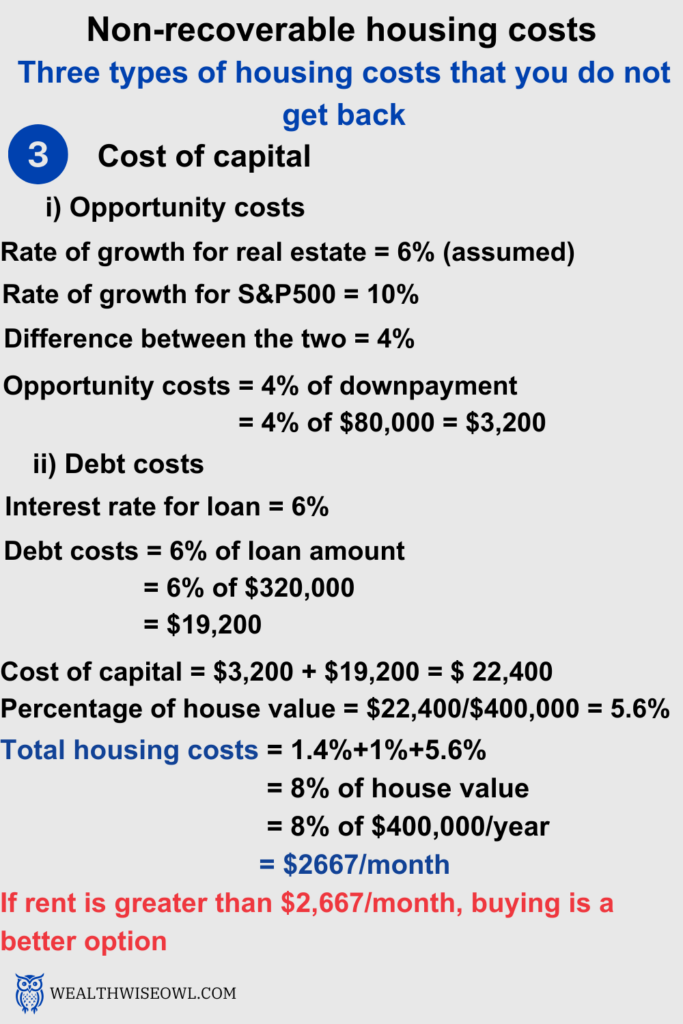

3. Cost of capital

i) Opportunity cost on downpayment

Downpayment = 20% of $400,000 = $80,000

Since stocks can outperform real estate by 2-6%, let us pick a number in the middle i.e. 4% for our calculations.

So, the opportunity cost = 4% of $80,000 = $3,200

ii) Debt cost is the average interest paid every year

= 6% of $320,000 (loan amount)

= $19,200

Therefore, the total cost of capital as a percentage of house value is = ($3,200+$19,200)/$400,000 = 5.6%

Let us add the percentages related to the three costs

= 1.4% + 1% + 5.6%

= 8%

So, 8% of house value is the housing costs every year that you need to compare renting costs to. In this example, 8% of $400,000 = $32,000/year or $2,667/month is the housing costs. If we can find a place to rent in the same area that is less than $2,667 then it is better to rent otherwise buying a house is a good option.

Wow! Finally I can see some numbers to settle the debate of buying vs renting a house. I know you mentioned this is a very simplistic rule and not everything is included in this calculation, but atleast it is a rough guideline to go by.

Yes, it is extremely important to know that this is not an exact rule and there are a lot of moving parts to it. The percentage we came up with needs to be calculated on a case to case basis. Also, we have not considered the tax benefits of owning a house since you can deduct the interest paid. Also, there is an assumption that if we go with the renting option, we will be investing the downpayment money in stocks. The appreciation of rent, property taxes and maintenance costs is also not factored in. All these assumptions and gaps in this rule may make it seem less reliable but in my opinion it is better than just hand waving about the pros/cons of buying vs renting.

I totally agree with your opinion and feel the same way about having some numbers to rely on rather than subjective opinions. I am going to use this in my house search and check if I can find an amazing deal that beats the renting option. Talk to you soon!