Why is it that after you make a big purchase that you start seeing content about how you could have gotten a discount or it was not the right thing to do? Maybe it is just psychology that anything related to the purchase catches our eye and we tend to focus on things that are negative. The same happened to me after I bought my house, which was unquestionably the biggest purchase of my life. After making the purchase I started seeing articles on how to decide if you can afford a house and if buying a house is even a good thing. Fortunately, I came out on the right side after evaluating my situation against the rules and guidance out there but it is scary to think had it not been the case. I would like to share the thumb rules I came across in YouTube videos from popular influencers on how to decide what price you can afford to buy a house based on your income. Take a look at the conversation I had with the Wealth Wise Owl to know more.

If you want to jump to a particular section use the links below

28/36 rule to calculate the house price you can afford

30/30/3 rule to calculate the house price you can afford

I found a lot of useful content from these Youtube videos’

How Much Home You Can ACTUALLY Afford in 2024 (By Salary)

How Much Housing Can You ACTUALLY Afford? (By Salary)

How Much House Can You ACTUALLY Afford (Based On Salary)

Conversations with Wealth Wise Owl

Hello good friend! Looks like a great day to be outside soaking up the sun!

Hi, good to see you! Yes, I have been enjoying this weather for a while now and it feels nice to be outside. How is your house search going? Did you find your dream home yet?

Don’t ask me about that. It feels like I have been to thousands of open houses and model homes but without any luck. I like something about every house and do not find it in the next one, nowhere can I find a house that has everything! Perhaps I am going about this all wrong, what do you think?

Yes, you probably should have a list of must haves that are non-negotiable for you and then short list the houses using that. Hopefully, the must have list will be small and now that you have seen quite a few houses it will also be realistic. Once you have short listed a few then you can start comparing them in the other aspects. It is good to give them points between 1-10 on the different criteria you are comparing them on and whichever ends up having the highest total is your dream house.

Wow, you have made my problem of decision making go away in 30 seconds. I should have come to you way earlier but I think going to several of these houses has helped me to visualize what is a must have. One thing that is on top of my list for a house is its price. I want to make sure that I can afford the house and not go overboard with my mortgage payments. Can you help me understand how I can find out how much of a house I can really afford?

That is an excellent question you ask and one that is most important. It is critical that you do not stretch yourself too thin with mortgage payments and do not have enough cushion to save or invest for the future. This way you would avoid being house rich and cash poor, which does not really help you because you cannot really use your house worth to enjoy a vacation or even cover your living expenses in retirement. House is not a liquid asset and you can only realize its worth after you sell it, which is a lengthy process and then again you need to find another place to live.

So, basically you should make sure that your house price is such that you can still meet all the other financial goals and abide by the financial order of investing. [Check out this blog to find out the right order of investing your paycheck or extra money]

Okay that makes a lot of sense to me. If I invest too much into a house then that is where I will be confined because I may not have money for anything else, especially after I retire or when my regular income stops.It is good you already gave me the steps to decide how to use my paycheck to refer to. Which step do I need to be at before I can buy a house?

You would need to be at least at Step 4, where you have saved up an emergency fund and have got rid of all the high interest debt. Then it is ideal that you can meet the goal of step 5, which is investing 25% of your gross income towards retirement, while paying the mortgage on the house. So, your house price should be able to meet those requirements.

I understand that and can see the logic of having an emergency fund because I do not want to worry about how I will make my mortgage payments if I lose my job for a few months. Saving towards retirement is a no-brainer because that will give me the ultimate peace of mind knowing that I do not have to worry when I get old and/or stop working.

That is correct, you got the reasons for completing those two steps exactly right! I feel that if you don’t meet the 25% rule and can say only do 20% for a couple of years to afford the mortgage payment then it should be okay. Depends on how desperate you want the house now because you might want it for your kid’s school, growing family, etc. After a couple of years there is good chance that your income increases or you refinance [check out the blog on when to refinance], so that you can get back to 25% investing rate again. Besides these steps there are a couple of easy to follow thumb rules to know what price of the house you can afford. They are based on the same logic as the order of investing but it is a slightly different approach. Are you ready to hear that?

Of course, I am curious and at the same time excited to know what you will share! Anything that helps me with making a decision on the house is gold. My ears and attention are all yours!

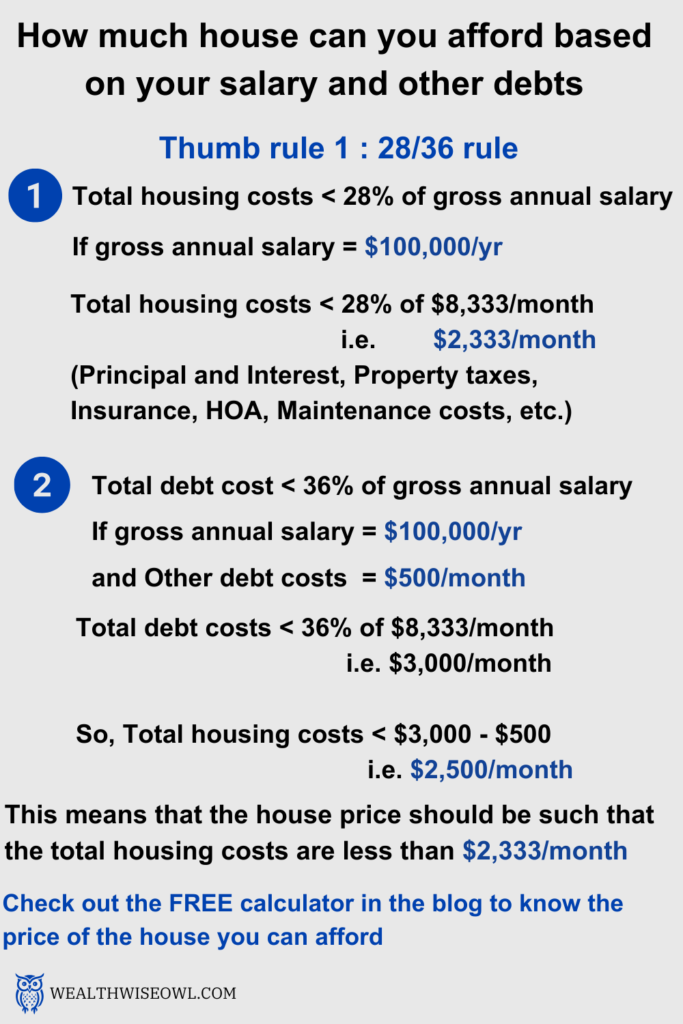

Great, so the first thumb rule is called the 28/36 rule.

The first part of the rule states that your monthly mortgage payment, which includes Principal and Interest, Property Taxes and Insurance, should be less than 28% of your gross or pre-tax monthly income. If you remember we talked about 8 things that makeup your monthly housing expenses and I just mentioned only four of those here. This is because the remaining four are discretionary expenses that you may or may not have. I would strongly advise to use all the eight numbers to estimate your monthly housing costs and make sure that it is less than 28% of your gross income. The lenders on the other hand may just check the four numbers to approve your loan, but they don’t care about your mental peace and are frankly looking to just sell you the mortgage. Therefore, it is important that you do your own due diligence before buying the house. [Check out this blog on how to estimate your monthly housing costs with 8 numbers]

The second part of the rule states that your total debt, which would include house mortgage, student loan debt, car loans, credit card debt, etc., should be less than 36% of your gross or pre-tax monthly income. This will give you the upper limit on the house price you can afford.

Okay, that is a neat rule that also takes into account the total debt, which I did not expect. Also, it’s good to know that some lenders also use this rule to approve the loan. I will totally use the total housing costs in this rule and not just the four numbers because I would rather be conservative here and know that I am not stretching my budget too much. Can we look at an example here?

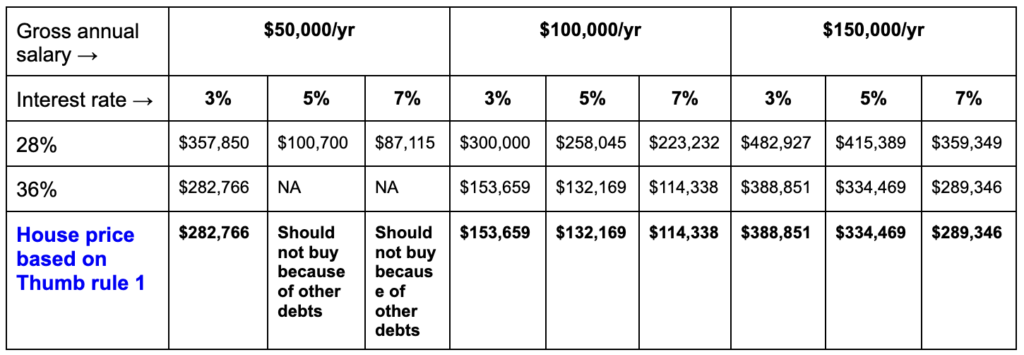

Yes, let’s do that. We can consider three different gross salaries and for each let us check for three different mortgage rates. The things we can assume constant are down payment amount, property taxes, home owners insurance and private mortgage insurance.

Gross salaries : $50,000/yr, $100,000/yr, $150,000/yr

House mortgage related details

Mortgage rates : 3%, 5%, 7%

Downpayment : 10%

Mortgage repayment term : 30 years

Property taxes : 1.2% of house price

Home owners insurance : $160/month (national average)

Private mortgage insurance : 1% of loan amount

Other debt

Car loan : $200/month

Student loan : $150/month

Credit card debt : $250/month

[You can use this FREE excel tool to run your own numbers and see the price of the house you can afford]

You can see that the 28% part of the rule gives you a higher house price but the 36% part of the rule gives you a lower house price because of the debt. So, these two parts of the rule will give you different house prices based on the debt. You should pick the lower number as the house price you can afford as you see in the table.

Wow, this is amazing! I like that you went through so many scenarios and I can now run my own numbers to see what I can afford. What is the other rule that you had mentioned?

I am glad you still remember that because after all this math it is easy to get overwhelmed, at least that is what happened to me! The second rule is called the 30/30/3 rule.

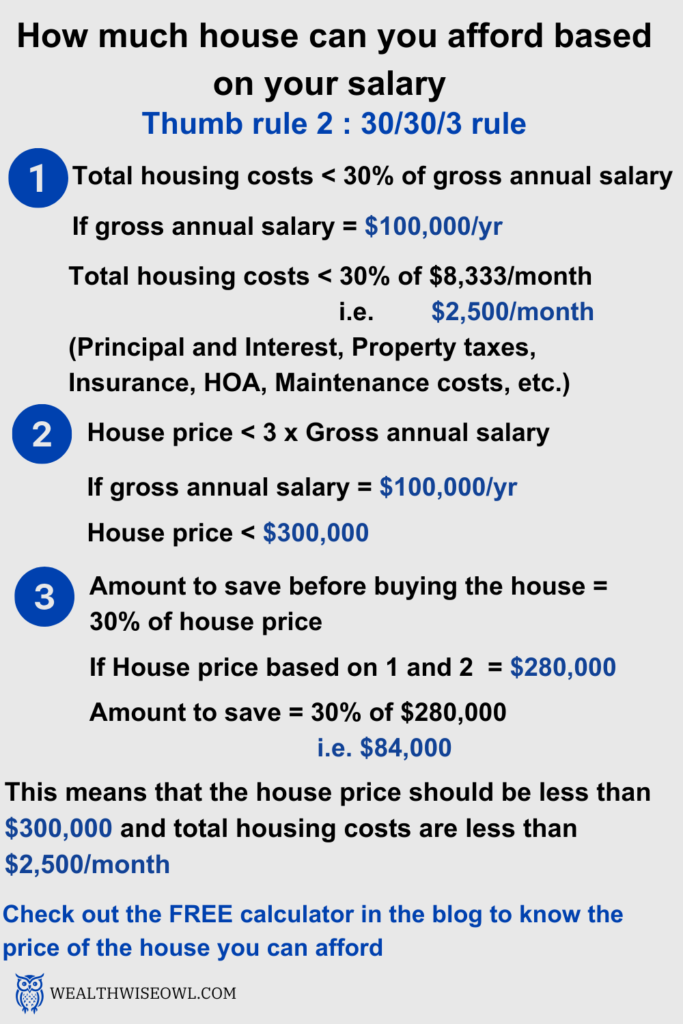

The first part of this rule, 30, says that your monthly mortgage payment should be less than 30% of your monthly gross income.

The second part of this rule, 30, says that you need to have saved at least 30% of the house price. The logic behind this is that a 20% down payment will held you get rid of the private mortgage insurance (PMI) and the rest 10% is for emergency repairs in the house.

The third part of this rule, 3, says that the house price should not be more than three times your yearly gross income.

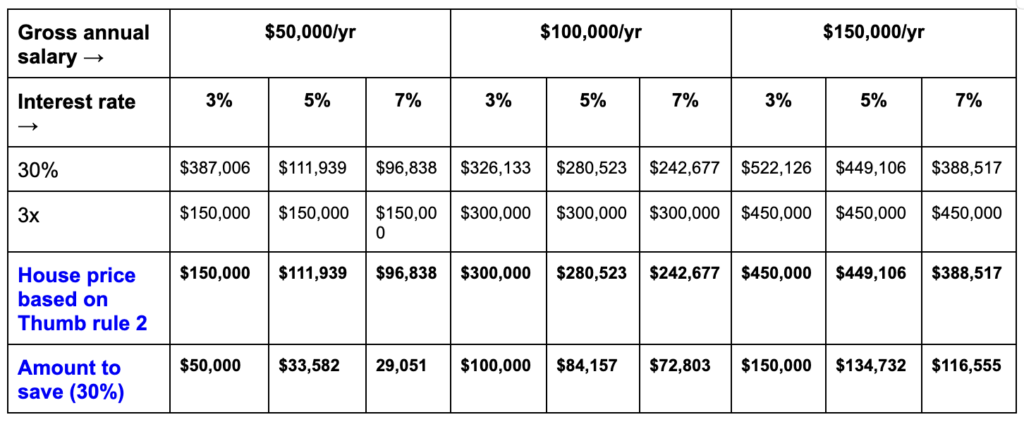

We can go through the same example that we had for the first rule here and see what we get. Here, the two different prices for the house are from the 30% of gross salary and 3 times the salary parts of the rule. Again, the lower value from these two numbers has to be selected as the house price you can afford. Next, before buying the house you should save at least 30% of the house price you get from above.

Nice, so this rule also gives a recommendation of how much you need to save before you buy the house besides the house price you can afford. But the downside of this rule is that it does not consider my other debts and, so, I will have lower confidence in this number. Overall, I like there are two different rules to look at but the problem is which rule should I use if they both give different numbers for the house price.

You are bang on about the drawback of the thumb rule 2, that it does not consider other debts. That is why it is always good to have multiple ways to get to this house price because each has its own strengths and weaknesses but combined they can help you get a better answer. I would recommend picking the lower value from the two thumb rules as the house price to afford since that will be the safest option.

That is a great recommendation! I will keep that in mind and now I feel so much better about continuing the house search process because the question about the house price I can afford is answered. This will help me filter my options and when I like one of those options, I will be confident that I can afford that house.