With the recent drop in Feds fund rate and more expected by the end of this year, everyone including me is wondering if this is the time to refinance your mortgage. I bought my house in the year 2022 and the interest rate on my mortgage is 6.625%. With the reference of 2-3% interest rates that some of my friends have, my interest rates seem huge and I am itching to get a lower rate. So, I decided to read up on how to determine the right time to refinance your mortgage. Read along the conversation with Wealth Wise Owl as we discuss how to run the numbers and decide for yourself.

Use these quick links to jump to a section on refinance option that you are interested in:

Download Your Very Own FREE Mortgage Calculator & Refinance Option Comparison

Conversations with Wealth Wise Owl:

Hello my friend! How is your rent and mortgage free living suiting you up there?

Hi old friend! It is frankly amazing to not worry about rent or mortgage and I am grateful that mother nature has zero living expenses! Do you want to move in on the tree next to me?

Haha..yes please, a tree house sounds wonderful and I can relive some of my childhood memories again. But, I already have bought a house and in a legal contract to pay my mortgage over 30 years aka my lifetime!

It is a long term commitment when you buy a house and I believe the mortgage payment will be your biggest monthly expense, correct?

Yes it is by far my biggest monthly expense and I am desperately looking for ways to reduce it! Could you please help me understand what my options are and how to pick the best one?

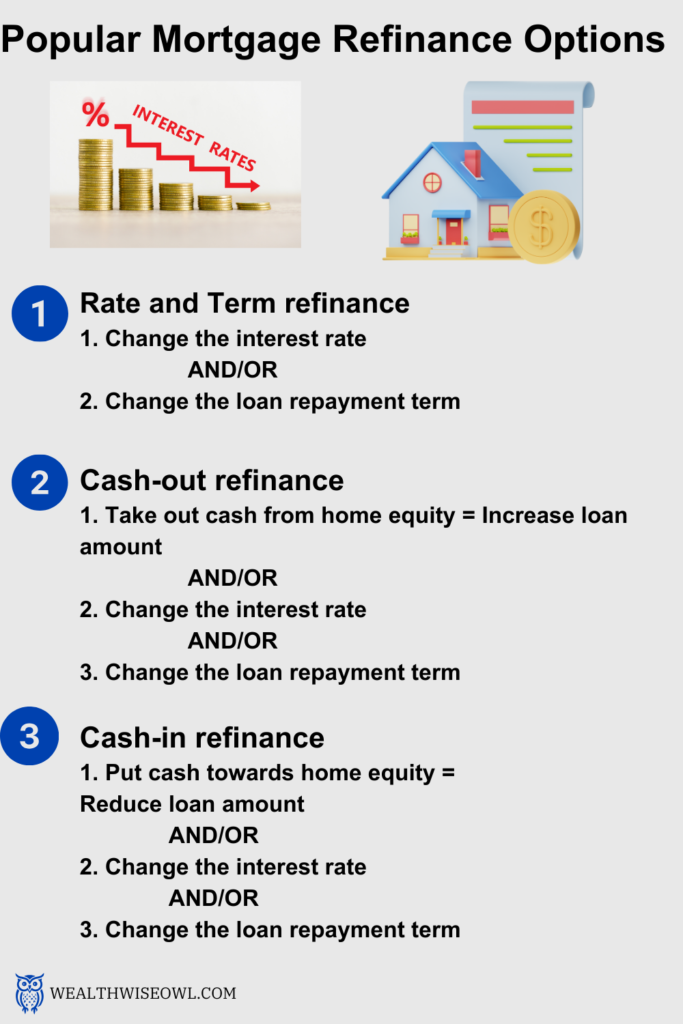

Definitely, let us chat about that today and find out what suits you the best. The most common way to lower your mortgage payment is to refinance. There are three main types of refinance options for a conventional loan with a fixed rate or adjustable rate mortgage. The technical terms for these are:

- Rate and term refinance

- Cash-out refinance

- Cash-in refinance

We will talk about each in a bit more detail but very briefly, refinance basically means applying for a new mortgage, which is what you did the first time you bought your house. When you refinance some lender will buy or pay down your current mortgage and offer you a new one on new terms. These new terms could be a different interest rate and/or a different length and/or different loan amount for the mortgage. The new terms depend on the type of refinance that you choose.

[Check out these links for more information:

https://www.rocketmortgage.com/learn/types-of-refinance

https://www.bankrate.com/mortgages/choose-the-right-kind-of-refinance/#rate-term-refinance ]

Okay, so I understand the concept of refinance and from the looks of it, it is not that straightforward with the different types and what they mean. I am sure you will break it down in words I can understand so I will be patient and let you explain what the different options mean.

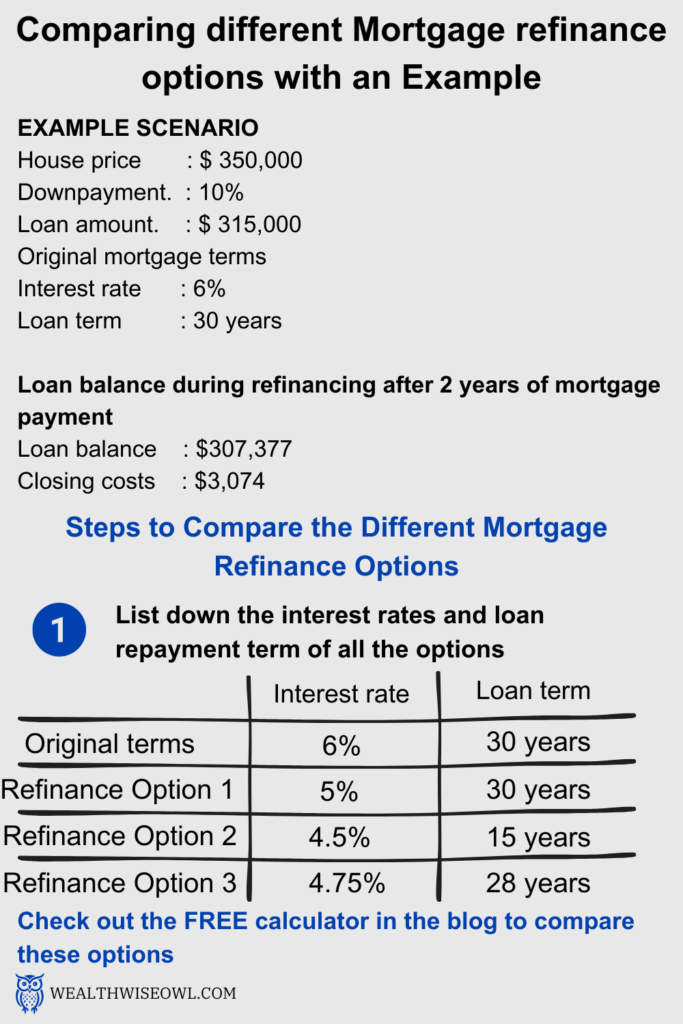

Yes, the jargon may seem complicated but you will understand it better when we go through some examples together. Let’s start with Rate and Term refinance. In this option you can get a new mortgage on the balance you owe at a new interest rate and/or a new repayment term. Let’s say you bought a house worth $350,000 with 10% as the down payment, so you will have a loan amount of $315,000. Assume you get a 6% interest rate over a 30 year term and you are considering refinance after paying for two years. Now, when you go for a rate and term refinance option, you can get either a new interest rate (preferably much lower than 6%) or a new repayment term (eg- 28 year, 15 year, 30 year)n or both on the remaining $300,000 loan.

I see, so the loan balance remains the same and I get to pick a new rate and/or repayment term on my mortgage. How do I know what combination would work best for me?

That is a great question and this is where crunching some numbers would help. One important thing to remember is that for any type of refinance there are closing costs involved similar to the ones you had while buying your house. They may be lower than the closing costs of buying the house for the first time but nevertheless they are there and can be 2-5% of your loan amount. (https://www.bankrate.com/mortgages/how-much-it-costs-to-refinance/) These costs will also factor in as you decide which option to choose but let us look at example of rate and term refinance options.

The options for rate and term refinance in the example we are looking at could be:

Option 1: Lower interest rate of 5% over a 30 year term

Option 2: Lower interest rate of 4.5% over a 15 year term

Option 3: Lower interest rate of 4.9% over a 28 year term

The numbers used in these options are just examples and you can ask different lenders for the exact terms that they are willing to offer. However, the trend of a lower interest rate for a shorter repayment term mortgage will always be consistent. Check out this link that talk about the relation between interest rate and loan repayment term 🙁https://www.investopedia.com/articles/personal-finance/042015/comparison-30year-vs-15year-mortgage.asp#:~:text=Because%2015%2Dyear%20loans%20are,with%20a%20higher%20interest%20rate. )

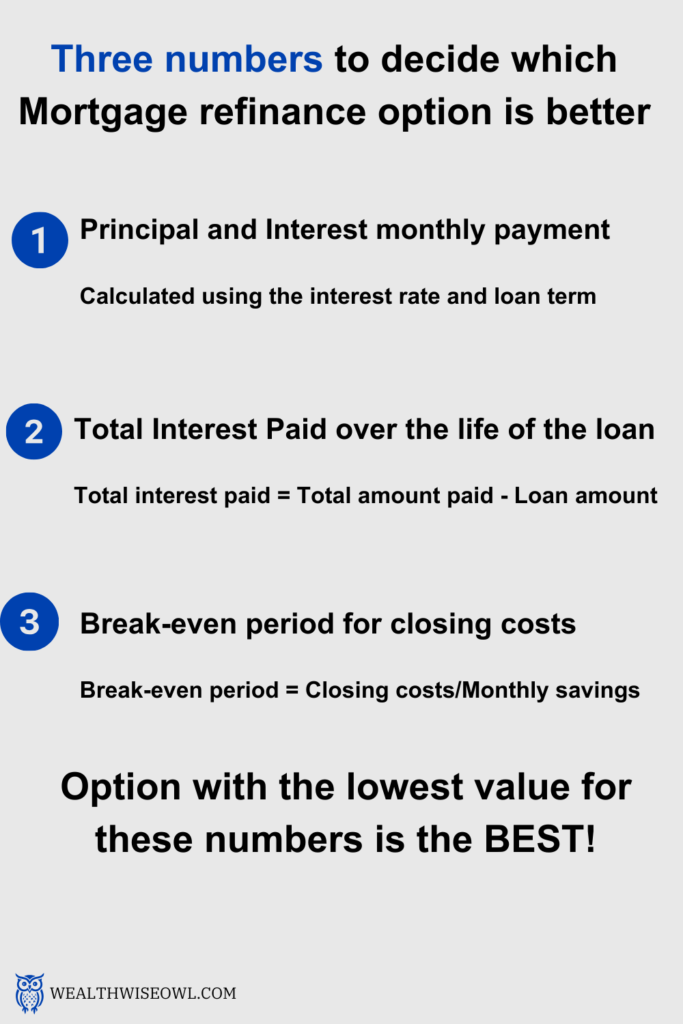

Once you have these options available, you can either ask the lender or you can yourself generate an amortization schedule which essentially tells you your monthly principal and interest payments over the entire term of your mortgage. To decide which option works best for you, there are two things to check from the amortization schedule –

- Monthly payment of principal and interest

- Total interest paid over the lifetime of the mortgage

- Break-even period for closing costs

Ideally you would want to lower both these amounts but if you can get only one of the two then the decision will be based on your personal situation. Let us look at our example to understand this. The three options for rate and term refinance above are compared in the table below. (Download this excel spreadsheet and you can run the numbers for your scenario to compare different options)

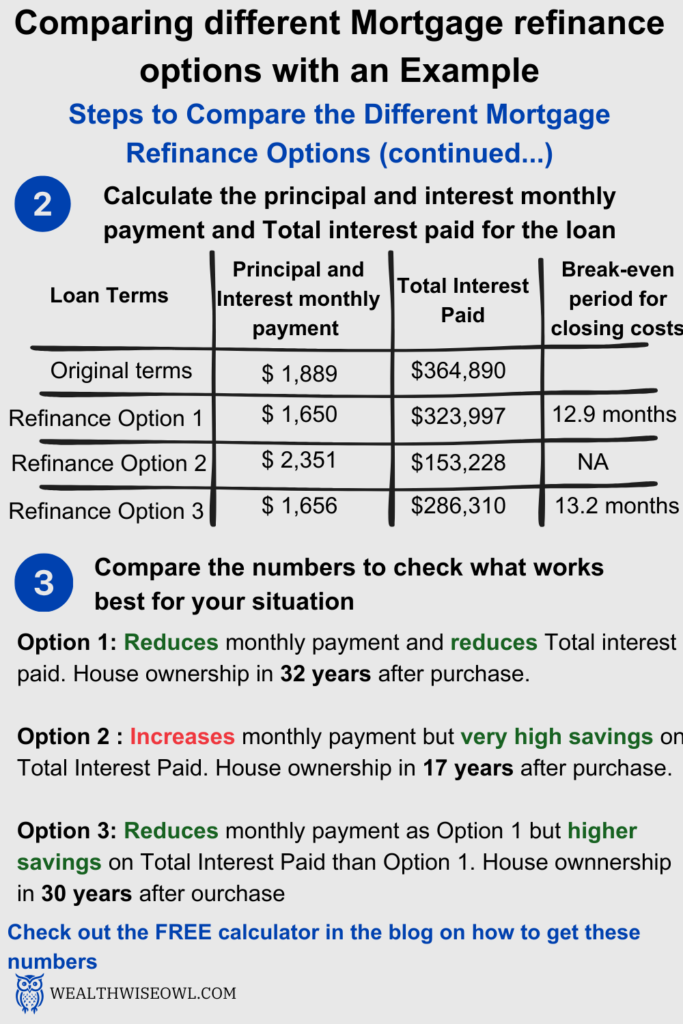

Option 1: The principal and interest payment has reduced by $239 and the total interest you will pay over the entire duration of the loan has decreased by $40,893. So, win on both fronts. However, it will take you slightly longer to own your home than your original loan term, which is 32 after you purchased it. This option will help you save money, where you can use that extra monthly savings for investing, but the only downside of this option is that you will own the house a bit later than your original plan.

Option 2: The principal and interest payment actually increased in this option by $463 but the total interest paid reduced by a whopping $211,662. This option will get you to complete ownership in just 17 years since you purchased your home. This option will mean higher monthly payment but you save a lot on the total interest paid and you get to own the house a lot sooner. So, if you can make that additional payment without compromising on your other financial goals (Check out this blog on Order of Investing to decide if you should make that extra payment), this is a good option. However, if making this extra payment means you cannot invest atleast 25% of your gross income and you are not in your 40s, then I would recommend not to go with this option. Since, the opportunity cost of not investing this money towards your retirement may cost you a lot more than you will save on interest. One day we will have a discussion on this specific topic.

Option 3: This option is not much different from Option 1 as you save about the same in terms of principal and interest payment i.e. $233. Although, the interest saved on the loan is higher than Option 1 at $78,580. Also, you will own the house at the same time as your original loan term i.e. 30 years. This Option is better than Option 1, since it does not change the timeline to own the house and also gives you savings on both the monthly payment and the total interest paid.

This is great, I am amazed to see how small difference in interest rates can have a huge impact on the interest paid for the loan. This table and analysis will be handy when I get my quotes from the lenders for different rate and term refinance options.

You definitely should do your own analysis and make sure you look at the different permutation and combinations of interest rate and loan term available from the lenders. As you saw from our example, it will give you more flexibility to make the right decision based on your situation.

One more thing to consider for your decision to refinance is the break even period for closing costs that you need to pay for refinance. This basically means how much time it will take to recover the money you spent to refinance and you can check if you will stay in the house for at least that long. For example, in the Option 1, where you save $239 and say your closing costs are $3,074 (assuming 5% of you loan balance). The break even period for this would be 13 months i.e. $3074/$239. Now, if you plan to stay in the house for at least 13 months then it would make sense to go for the refinance but if not then you will not benefit from the monthly payment savings that you paid the closing costs for.

There are also options to add your closing costs into the new loan, which will increase your loan amount at the new loan terms. So, the break-even analysis may not apply there but you can compare the numbers for principal and interest monthly payment and total interest paid with the other options.

That makes sense, I need to make sure that I am stay in the house long enough to realize the benefits that I am paying extra for. Break-even is such a neat little term for that, I will remember that and it will also help me make other financial decisions too where I am looking to spend some extra to get additional benefits.

Definitely, the break-even period concept is very common in the finance world and even in other industries for decision making on improvement projects. Okay, now we can look at the other refinance options. The next one is Cash-out refinance. This basically allows you to access the equity in your house and use it for other purposes. For example, after paying your loan for 2 years, you have an equity of say $10,000. This equity amount is obtained by subtracting the outstanding loan balance from the current value of your home, so you would need to get this number from your lender. If you opt for Cash-out refinance then you will get a check for $10,000 and your loan amount will increase by this same value at the interest rate and loan term that you select. You can calculate how much extra interest you will end up paying due to the increase in loan amount or can you actually get a very low interest rate that would not increase the total interest payment. I feel that this option makes financial sense if you want to use that money to pay down high interest debt, like say the credit card debt which is at 20-30% interest rate. The fancy term for this transfer of high interest debt to a lower interest debt is Debt consolidation. I would recommend not to use this money for discretionary spending like vacation, buying a luxury car, etc.

I see, so this option seems like it is best to switch the debt which is at high interest to a lower interest by using the equity of your house. I would definitely consider it in that situation. So, is Cash in refinance option the very opposite of this?

Yes, Cash-in refinance is where you would pay money towards the loan when you refinance. This can happen if you have a lump sump of extra cash that you want to pay down your mortgage with. Instead of getting a check at closing like in Cash-out refinance, here you will be the one giving the check. The main reason to go for this option is if you want to reduce your loan to value ratio below 80%, i.e have an equity of atleast 20% in your house, to get rid of Private Mortgage Insurance (PMI). You can also do this by doing a “Mortgage Recast” where you can make the lump sum payment and keep your current mortgage terms. But if you want to get new terms for the mortgage then Cash-in refinance is the way to go

Okay, this is a great option around bonus time or if I win a lottery that gives me lump sum cash to put towards the house. Thank you Wealth Wise Owl for going through all the options. I am looking forward to play with the excel calculator to compare different options. If I find a money saving deal, you are sure to get invited to a feast that I will have to celebrate. Till we meet again, take care!

Of course, I will keep an eye on my mail to look for your invitation because I am sure you will find a great refinance deal soon which will save you a ton of money. Take care and talk to you soon!

[…] the lender for offering you the loan. Both these components change when you refinance your loan. [Check out this post on how to decide if the time is right to refinance and which option to choose] What you will find interesting is that majority of the mortgage payment you make in the initial […]