What do you do with your paycheck after spending on all the essentials? Do you ever wonder what you should prioritize to set up for success? These are all good questions when we start our financial journey. The technical term that is often used for a strategy to invest money is “order of investing”. Some of the popular financial influencers also use the terms “Baby steps” (Dave Ramsey) or “Financial Order of Operations” (Money Guys). I have learnt a lot from watching, listening and reading their content, which I try to use it in my day to day life decisions. Full credit to these folks for simplifying complicated financial decisions and showing the path. It essentially is a step-wise approach to build financial wealth over the long term. We will chat with the Wealth Wise Owl about this and get some details about the strategy that he recommends. To jump to any of the steps please use the links below:

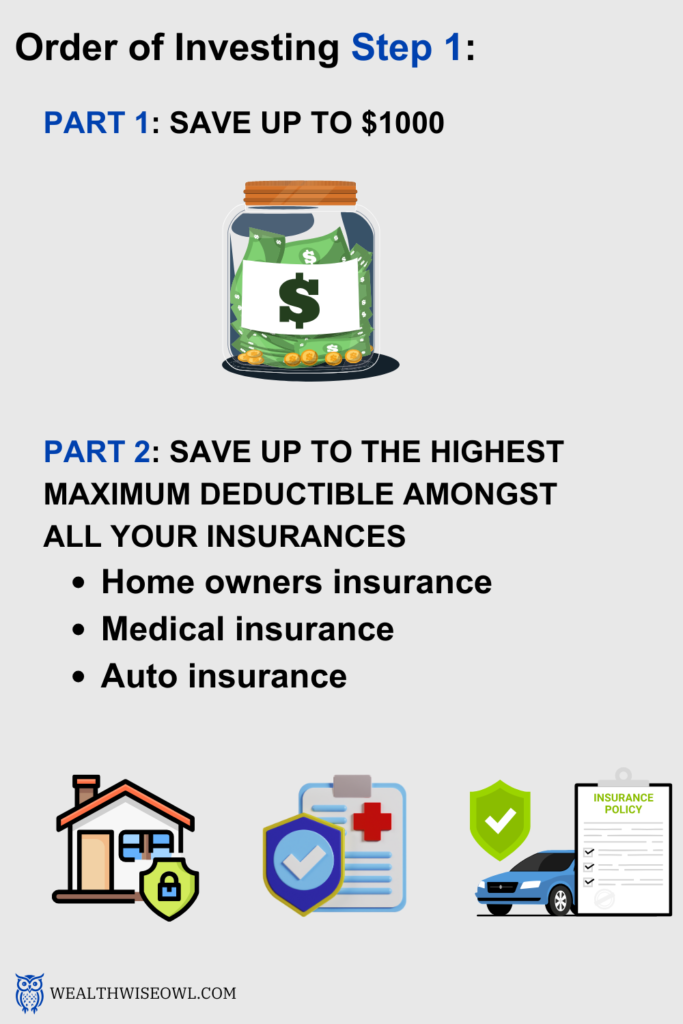

Step 1 : Save up to $1000 and preferably up to the highest maximum deductible among your insurances

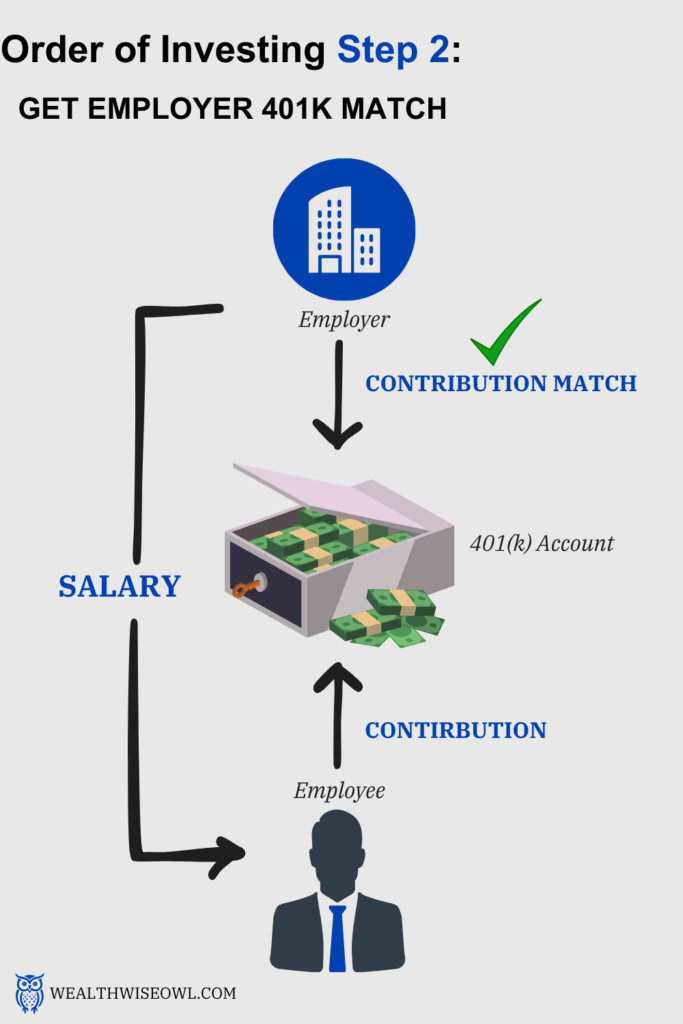

Step 2 : Get employer 401k match

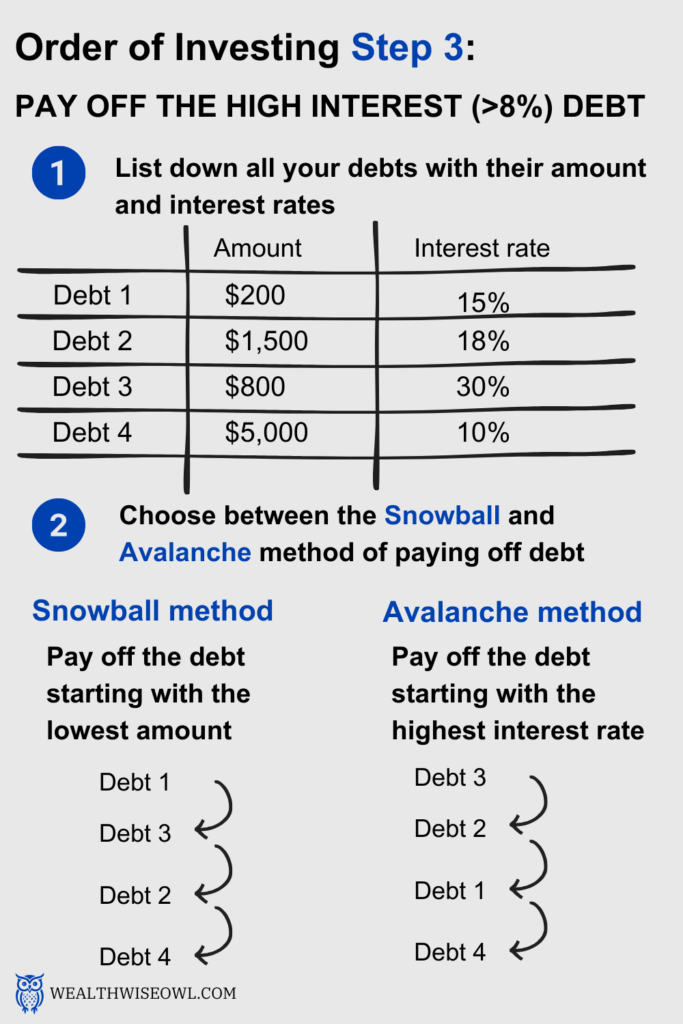

Step 3 : Pay off high interest debt

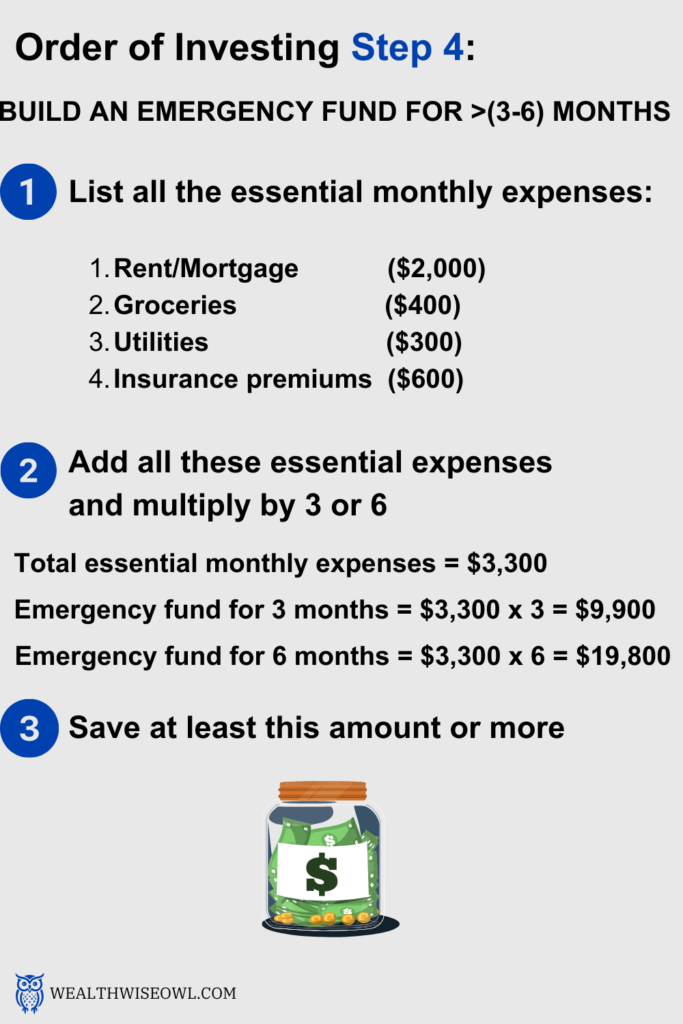

Step 4 : Build an emergency fund

Step 5: Invest 25% of gross income

Step 6 : Save for future goals/expenses

Step 7 : Pay off low interest debt

You can check out these youtube videos for more content on the order of investing your money.

Brian Preston (Money Guy Show): Financial Order of Operations

Optimal Order For Investing Your Money

The 7 Baby Steps Explained – Dave Ramsey

Use This Paycheck Routine EVERY Time You Get Paid

Conversations with the Wealth Wise Owl

Hello Wealth Wise Owl! I haven’t seen you around for a while, looks like you took off for a vacation.

Hello old friend! Yes, I had a quick summer getaway to cool a bit and relax. What have you been up to?

Same old same old. I am progressing with my financial education and recently have been thinking about the best strategy to put my money to use. I would like to know what you think.

That is a great question to think about because once you have a solid plan in place, you can put your money investment strategy on autopilot and not worry about it on a daily basis.

Yes, that is my plan. Otherwise I always keep wondering if I have the most optimal strategy to invest my money. There are so many options out there like 401k, investing in stocks, paying down your mortgage, etc. that it gets confusing. The worst thing is that from all this confusion, I am reluctant to do anything.

I understand your confusion and with so many options it is hard to evaluate which one to choose over the other. I have an order of investing in mind that you can follow or atleast use as the basis to build on. You can think of this order as a series of buckets you need to fill, where after you fill the first one you can move on to the next. The source for filling this bucket is the cash you have left after paying off all the essential expenses like rent, utilities, grocery and insurance premiums. Depending on the amount of cash you have to work with and your financial situation, you can fill multiple buckets at the same time. You will realize that once we talk through the entire order of investing.

That sounds wonderful, it will be more than helpful to have something to start with. The bucket analogy is easy to grasp and I have a good mental picture of me standing with a cash hose filling several financial buckets. I got my pen and paper ready and my ears are all yours!

Okay, so the Step 1 in the order of investing is to have at least a $1000 of emergency funds in a high yield savings account. This is to have some money saved for car repairs, small medical bills, house repairs, etc. so that you do not have to sell any of your other investments or take on high interest debt. I should say this is part one of the first step and part two is to save up to the maximum deductible you have amongst your insurances (house, medical, car, etc.). Since the maximum deductible is the amount you will have to pay from your pocket, it will determine the value of your emergency fund.

That is a good place to start. I will have to check which one of my insurance has the maximum deductible but I am pretty sure it is my medical insurance since I am on a high deductible plan.

Once you have saved up to this maximum deductible amount, in Step 2, you can look to match your 401k employer’s match. This is essentially money that your employer contributes to your retirement plan to match your contributions. For example, let’s say you have a $100k/yr salary and your employer offers 100% match up to 4% of your contributions. This means if you contribute 4% of your salary towards the 401k plan, i.e. $4,000, then your employer will match that 100% and contribute $4,000 to your 401k account. This is essentially a 100% guaranteed return on your investment and helps you get started on your retirement savings. [If you want to learn more about employer match or retirement savings account, check out this blog post – The Ultimate 401(k) Guide For Beginners]

Yes, my employer does have a 401k match and you make a really compelling case to avail it. 100% return on investment! No wonder it ranks higher in the steps for the order of investing. What’s the next one?

If you still have money left after contributing enough to get an employer match, then Step 3 is to start paying off your high interest debt. This high interest debt is your credit card debt, car loan or student loan. I would say anything above a 8-10% interest rate would be classified as a high interest rate since it is above the average rate of return you would get on investment in the stock market. Now there are two different ways you can attack this high interest debt.

One is the Snowball method which is based on psychological benefits and the other one is the avalanche method which is based on financial benefits. In the snowball method, you arrange all your debts in an increasing order and then start paying them down from the top and work your way down. Remember to keep making the minimum payments on all the debts while you pay extra towards the principal of the debt you want to pay off first. This method gives you a psychological boost that you are making progress by reducing the number of debts.

On the other hand, in the Avalanche method you should arrange your debts in decreasing order of interest rates and then start paying down the debts from top to bottom of that list. Again, here too you should be making the minimum payments on all debts first to avoid the penalties and then put the remaining money towards the principal of debts you want to pay down. This method is financially beneficial since you will pay a lesser amount of interest by attacking the higher interest debt first. You can choose either of the two methods based on what makes the most sense to you but they will both help you achieve the same goal of getting rid of your high interest debt.

Wow, these are neat techniques to attack my high interest debt. I can see the logic of paying them down since the percentage interest rate on these debts is equivalent to the rate of return you get from paying them off. If I see this as a rate of return on the payments I am making towards the debt then I feel much better about it.

You are thinking of this the right way and have put a positive spin on it! Super impressed by you here! Okay, so after you have paid down your high interest debt, the Step 4 is to save for an emergency fund to cover loss of employment. This can be 3-6 months of your essential living expenses that includes rent, utilities, grocery and insurance premiums. The number of months you need to save for depends on how quickly you can find a new job in your industry. Another factor that determines the number of months you need to save for is the number of dependents. If you have a family, especially kids that depend on you, then you might want to have a bigger cushion to cover you during hard times. One thing to keep in mind is that the emergency fund should not be locked in an investment like stock market or even CDs but should be liquid for you to access immediately like in a high yield savings account or a checking account.

I see, this emergency fund like the one we had in step 1 will prevent me from getting high interest debt if I lose my job. I will also have the peace of mind that I have something to fall back on and will be less stressed while looking for new work opportunities. I will call this step the safety net for me to remember.

You got that right and a perfect name for the step! All the steps up to now were a way to build a solid foundation for your financial independence. This will help you stay the course on your financial journey even in the face of unexpected events. Step 5 is where the fun of building your wealth starts and we use the magic of compounding. You need build up to investing 25% of your gross income. This may not happen immediately but as your income goes up or you start becoming efficient with your budget, you can start putting more money towards investing for your future and gradually build up to 25%. Remember that time is your best friend here so the earlier you can get to investing, the faster your wealth will build and faster you can put your feet up to relax with financial independence.

I love the sound of this, especially the part where I can put my feet up and relax! I cannot wait to get to this wealth building step. So, what should you invest your money in? I know there are multiple retirement accounts that we had talked about before [check out the link here] but how do you know which ones to prioritize?

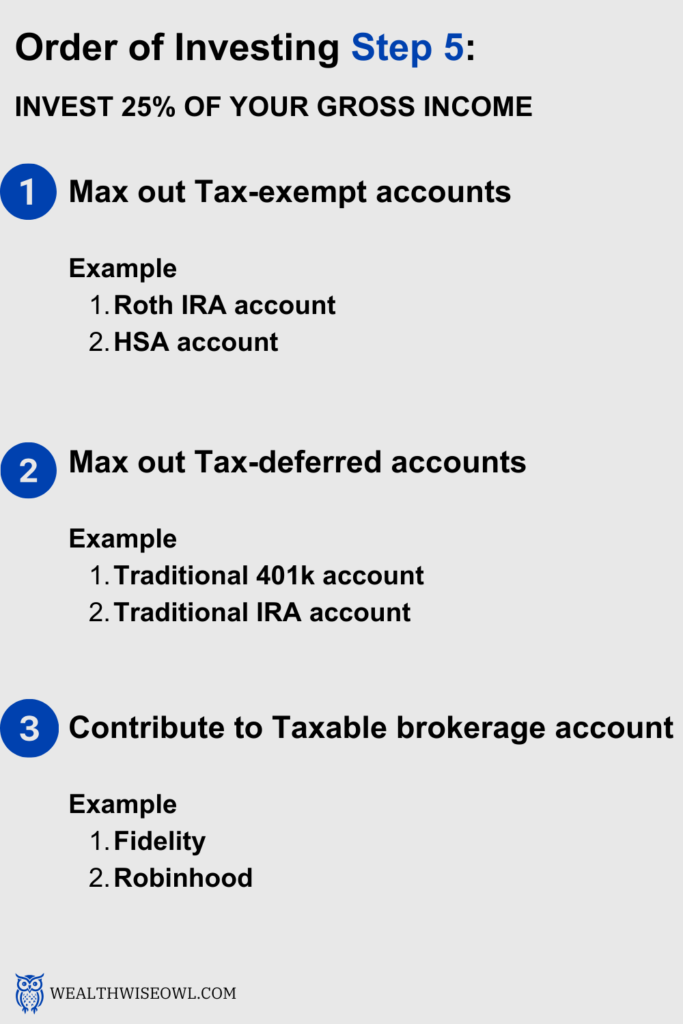

You remember all the important stuff and have really good questions! Yes, there are the three types of accounts we talked about – tax-exempt, tax-deferred and taxable accounts.

You should prioritize putting money in the tax-exempt account first like the Roth IRA and HSA [Check out this post for more details on these accounts – Accounts you must have during retirement]. This builds your wealth in tax-free dollars and so you want to give these accounts the maximum time to compound your wealth. Since these accounts are so good they also have the lowest maximum limits that you can contribute up to because the government wants you to pay more in taxes!

After you contribute to these accounts till the maximum based on your tax-filing status and eligibility requirements, you can begin to maximize contributions to the tax-deferred accounts like your 401k. In step 2, you have already contributed enough to secure an employer match but now you can go above and beyond that number and contribute to the maximum allowable limit based on your eligibility. Even though money in these accounts cannot be withdrawn tax-free, you can avail the tax benefits now when you contribute which essentially means more money available to you for investing.

Finally, after maxing out contributions to both tax-exempt and tax-free accounts, you can start putting money towards the taxable brokerage accounts, which could be with Fidelity, Robinhood, Charles Schwab, etc. These would give you greater flexibility to withdraw money during retirement and reduce the tax burden.

Contributions to all these three accounts should be at least 25% of your gross income and this will help you supercharge your journey towards financial independence. [For more details on the contribution limits on retirement accounts check out this post – Ultimate Guide to 401k accounts]

The magic number is atleast 25%, which looks steep for me right now but I now have a goal to work towards. I am glad that we had talked about the different types of accounts, their benefits and the contribution limits before so all what you said was not a bunch of jargon for me. I will go back to my notes to get a refresher though. So, what is the next step if and when I get to investing 25% of my income?

Okay, once you complete step 5 you first need to give yourself a pat on your back because you have done the hard yards and now you get to have some fun. Step 6, is saving your money for your future goals or expenses. This could be saving for your children’s college, investing in real estate that could also include down payment for your house if you do not already own one or saving for a vacation. Your personal preference matters here and you can prioritize your saving goals any way you want. I also see this as rewards you can enjoy now rather than delaying it till retirement but remember it should not add to your high interest debt so stay within your means.

I am already daydreaming on all the things that I will save my money for in this step. It could be a while before I reach this step, so let me write all the things on my mind before I forget! I am pretty sure this list will keep changing and get bigger! Is there a lucky number 7 step too?

Yes, Step 7 is to pay off the low interest debt you have, which will most likely be a mortgage on the house if you have already bought one. The closer you are towards retirement the more urgent it will become to pay off your mortgage because it will be much better to be debt free when you hit retirement age and/or choose you stop working for a regular stream of income.

Awesome, I will keep that in mind when I own a home but there is enough for me to do in the meantime. I am so excited to get started with all these steps and it gives me so much clarity on how to setup my financial journey. I will not have to keep wondering if I am doing the right things with my money or if I need to prioritize something else than what I am doing now. Thanks a lot my friend!

You are very welcome! I am confident that you will crush all these steps and you can then put a chair here besides me to chill out! While you are going through your journey always look to be charitable with your time and resources. You can give back to your community through volunteering or advising younger folks than you on all these financial concepts. Believe me it feels so much better to help someone than any amount of money you will end up with!

[…] So, if you can make that additional payment without compromising on your other financial goals (Check out this blog on Order of Investing to decide if you should make that extra payment), this is a good option. However, if making this extra payment means you cannot invest atleast 25% […]