The dream for anyone who starts investing is to make a lot of money from selling their investments at some point of time. It seems straight-forward to make money when you hear things like buy low and sell high. But when we really see how many people come out successful in this area it does not seem that easy. One of the reason is that there is a lot more to than buying low and selling high. The prices that matter are not just what you buy and sell the investments at but there are these fees, taxes, etc. around investments that can make or break it. I wonder how much you actually profit from selling investments and do you even get to keep it all. This is the question I had for Wealth Wise Owl and got to know some interesting facts that I would like to share.

If you want to jump to the chat about some specific accounts please use the links below:

- Trade Commission fees

- Bid-Ask Spread

- Loads or Sales Commissions

- Asset management fees or Advisor fees

- Expense ratios

- Taxes

Conversations with the Wealth Wise Owl

Hello Wealth Wise Owl, top of the morning to you!

Hellooooo, you seem to be in a jolly mood today. It must be that your investments are doing well and everything is in the green like the tree I am sitting on.

I did not know it was that obvious. I guess it is hard to hide my happiness when I look at my portfolio and find that I am making profits on my investments.

Yes, it is definitely a nice feeling to have and you must know that very few people actually are able to experience that. The stock market can be a brutal place, especially in the long run, if you do not make educated decisions since your luck can only get you so far. Like they say, making money in the stock market is simple but not easy.

Woah! That is deep and I will let that last line sink in. To be honest, I have had a good amount of luck when I picked some of my investments and rest were basically based on what my friends were doing. I am on the journey to get financially educated and hope when I celebrate my profits next time, it will be more from my efforts than sheer chance.

That is definitely a great initiative from you and you showed great character by admitting to the role of luck. As we chat more, I am sure you will make a lot of progress and reach your goal of becoming financially educated.

I hope so and am grateful to have found an amazing teacher in you. My today’s question is about how much do I actually make in profits from investing in stock market after all the fees and taxes? Is it as simple as seeing how much I am in the green and assume that is what I can take home after selling my investments?

That is an important question you just asked! It is easy to not read the fine print when investing and then get surprised when you have to foot the bill. There costs that you need to pay at different stages of the investment, so the money you actually make in the stock market is usually less that what you might see in your portfolio. There are fees that you might have to pay:

- At the time you buy the investment,

- Annually for holding the investment

- At the time of selling the investment

We will go over these one at a time and I am sure you will get a lot out of it, so strap your seatbelts on!

I have my notepad and pen, let’s go!

Okay, let’s start with some of the fees you need to pay when you buy an investment.

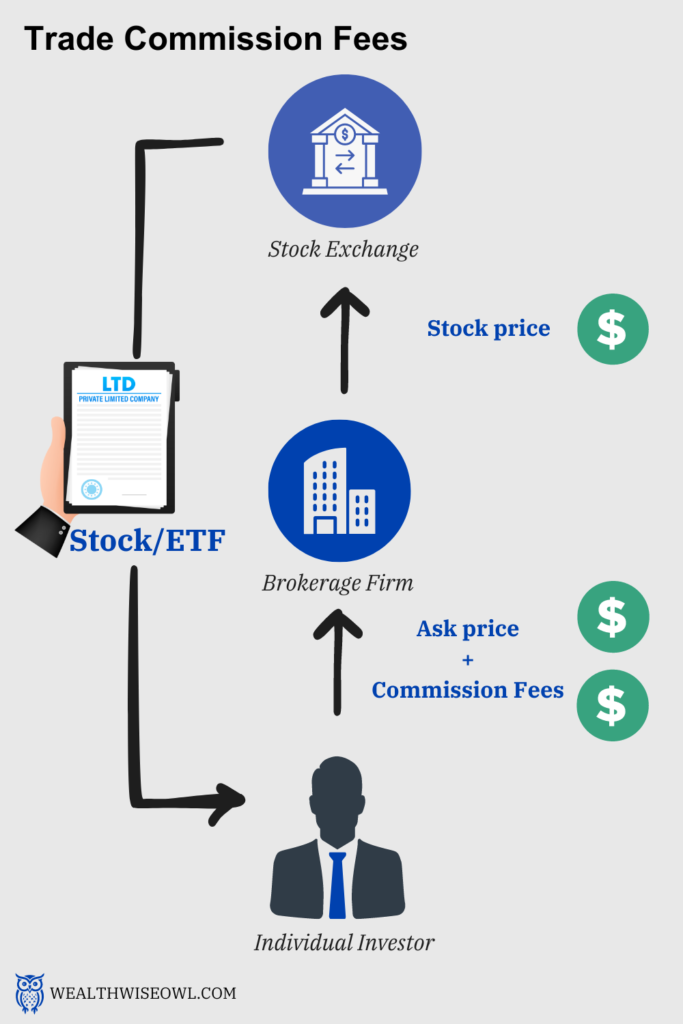

1. Trade commission fees

This is the fees you will have to pay your brokerage for routing, executing and clearing the buy or sell trade for you. These days a lot of brokerages offer zero commission trades due to the trend started by Robinhood. It is better to get this information from your brokerage before executing any trades because if you trade frequently, these fees can pile up and significantly dent your returns. One interesting debate around the zero commission brokerage accounts is the morality of “payment for order flow”, which are also called hidden fees. The order for buy or sell you place on your zero commission brokerage (eg – Robinhood) is actually sent to a wholesale market maker (eg – Citadel), who then places the trade on the exchange like the NYSE. The market maker pays the broker for the right to execute the order. So, what this is doing is essentially introducing a middle man and does not guarantee us the best available price on the exchange. The brokerage may also have a conflict of interest since it is supposed to find the best deal for us but is also getting paid by the market maker to send the trades their way. Here are some good you tube videos that explains this concept really well:

Four Hidden Costs of Zero-Commission Brokers

Payment for order flow: The relationship between brokerages and wholesalers explained

Dark Pools, Payment for Order Flow & Market Structure | Office Hours with Gary Gensle

I had no idea there could be something wrong with zero-commission brokerage accounts, which are basically all of my accounts now. I should have known that there is no such thing as a free lunch!

Yes, that is why these are also called hidden fees since they are not apparent. Another lesser known fees that does not get talked about is the difference between bid price and ask price.

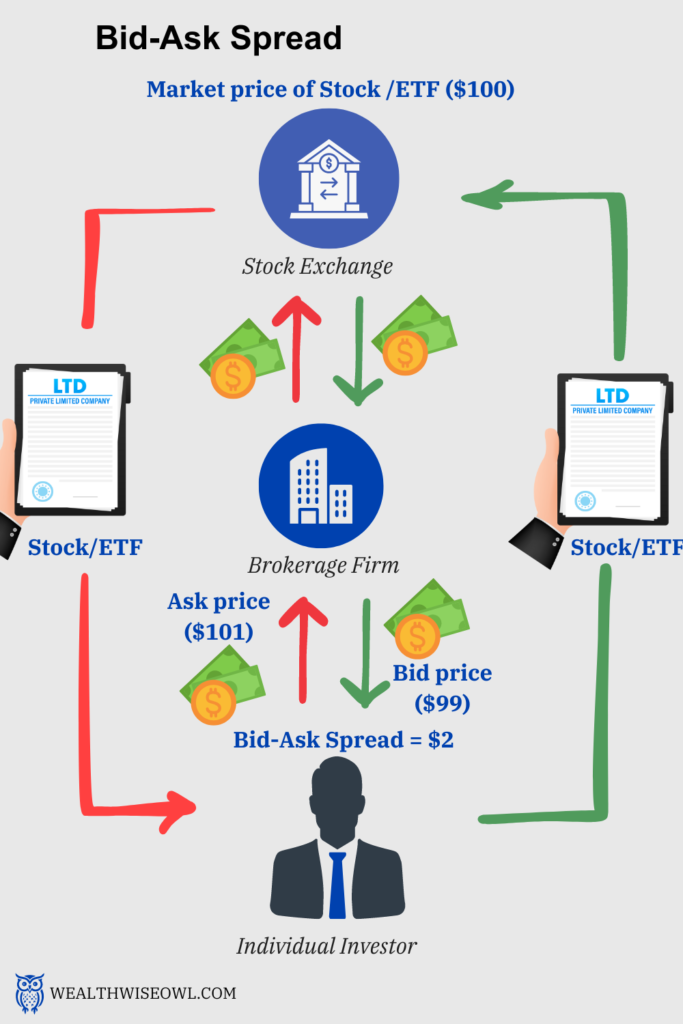

2. Bid-Ask spread

Securities like stocks and ETFs are traded on exchanges like NYSE, which you can think of as a marketplace for buying and selling stocks. Now, in order for you to buy or sell on this market place you need to go through a broker or brokerage who makes the trade on your behalf on the exchange. There is a commission fee that is paid to the broker for making the trade, which was like a flat fee per trade. However, nowadays the zero commission brokerage accounts do not have these commission fees. Even though you may not be paying commissions, there is a lesser known fee that is called the bid-ask spread. First, It is important to first understand what bid price and ask price means. What you see as the price of a stock on your brokerage account is the market price. However, this is not the price at which this stock is being bought or sold on the market place. The stock is usually bought at a different price, bid price, which is lower than the market price. On the other hand, the stock is also sold at a different price, ask price, which is higher than the market price. The difference between the ask price and bid price is the bid-ask spread. You always end up on the losing side of the bargain from these differences in prices. For example, if you see a stock that has a market price of $100, then its bid price could be $99 and its ask price could be $101. So, if you decide to buy the stock, then you will need to pay the ask price, which is $101, since that is the actual price that the stock is being sold at on the exchange. However, if you decide to sell the same stock, then you will receive the bid price for that stock, which is $99. So essentially, you lose $2 when you buy and sell the same stock. It is usually the market maker that makes the actual trades on the exchanges that pockets the spread.

I did not realize how much I did not know about these underlying mechanics in buying or selling investments on the exchanges. I had assumed it is very similar to a grocery store where the price on the item is what you pay but not here is what i understand. There is a huge difference when buying from the store for stocks aka exchanges.

Exactly! There is very little you can do to reduce these fees and they are unavoidable if you use the brokerages to make your trades. But you should know these exist and appreciate the complexity of these trades that seem simple while using the brokerage apps. Now, let’s move to fees that are somewhat in your control and that you pay at the time of buying/selling:

3. Loads or Sales Commissions

Some of the mutual funds charge an upfront fee for buying the fund, which is called a front-end load. This is usually a percentage of the amount you invest in the fund and is a one-time fee that you pay at the time of purchase. For example, if a fund has a front-end load of 5%, then a $1000 investment in the fund will have a fee of $50 and your actual investment will be $950. The percentage value may seem higher and it hurts to pay so much upfront but the argument for this fee is twofold. One, the fees is to compensate for the expertise of the professionals that manage the fund, so you can expect to have good returns from this fund. Second, you do not have to worry about paying any other fees over its lifetime as the fund grows in value (there may be taxes you might have to pay on some of the mutual funds so be sure to check for that).

There is another type of load called the back-end load and as the name implies this fee is applied at the end, when you withdraw from the fund. These fees are sometimes higher than the front-end load, so even though you can invest the full amount that you pay for the fund, you would receive less than the actual growth of the fund.

4. Asset management fees or Advisor fees

If you hire a financial advisor or an institution to manage your portfolio, these fees would apply to you. These fees are usually a percentage of the total portfolio amount and usually that percentage decreases for higher portfolio value. This reduction in percentage of fees for higher invested amounts is a good incentive to allocate higher amounts to your portfolio. In most cases this type of fees are above and beyond the other types of fees associated with the funds like the expense ratios, loads on mutual funds, etc. You should carefully consider the option of getting your portfolio managed professionally. People have strong opinions on either choice. Those who advise professional management of funds claim that this is a safe option if you do not know what you are doing when investing money and this would avoid loss of capital. However, those who advise against this claim that passive investing in index funds outperforms 80% of professional fund managers over the long term, so you would be better off just buying these funds. Moreover, the fees you pay diminish your returns significantly over the long term.

Good to know! I will be sure to keep a look out for these types of fees when buying investments and will do some research on whether a financial advisor would make sense for me now, considering I am just starting out.

Yes, you should definitely do your own research and see what fits your needs for now. This is a personal decision since the level of confidence in investing and risk tolerance varies from person to person, which is not as easy to quantify as the fees that we have been talking about. Now, we will talk about a fees that you will have to pay out annually as long as you hold onto the investment.

5. Expense ratios

This is an annual fee for owning an asset that is a percentage of the funds invested in the asset. For example, a 0.5% expense ratio would mean that if the value of funds invested in the asset is $1000 then you will pay $50 in expenses that year. These expense ratios are common for mutual funds and exchange traded funds (ETFs), which can be found in the fund’s prospectus. These expenses cover the operating and management costs of the funds, which includes fees for auditing, accounting, custodian, etc. Actively managed funds or active funds have higher expense ratios than passively managed funds. The main reason is because in active funds, fund managers make decisions on investments within the fund with the aim to outperform the market. Since these decisions are based on research by a team of analysts, the expenses are higher to cover the costs of the team’s expertise and time. On the other hand, passively managed funds or passive funds have lower expense ratios since they simply track a benchmark or index of a certain segment of the market. Fidelity Contrafund (FCNTX) is one of the largest actively managed funds and Vanguard S&P 500 ETF is a passively managed fund that tracks the S&P 500 index and has the lowest expense ratio of 0.03%.

It is important to factor in the expense ratio to decide which funds to buy. A simple way to compare funds which have different rate of returns and different expense ratios is to simply subtract the expense ratio, expressed as a percentage, from the fund’s rate of return. This is the effective or net rate of return after factoring in the expenses. A higher value of this effective rate of return will indicate better performance of the fund. It is always recommended to compare the rate of return over a long term, 5 years or more. For example if we compare two funds, Fund A and Fund B. Where, Fund A has an expense ratio of 1% and an average annualized rate of return of 12% over a five year period. On the other hand, Fund B has a lower expense ratio of 0.05% and the annualized rate of return over a five year period is 8%. Then the effective rate of return for Fund A is 11%(=12% – 1%) whereas that of fund B is 7.95%(8%-0.05%). So, even though Fund A has a higher expense ratio, it delivers a higher rate of return which more than compensates for the higher expenses. Based on this metric fund A seems to be a better choice compared to fund B. It is important to note that we assume all other expenses like taxes, loads, commissions, etc. related to these funds are the same. If this assumption is not true, then a more detailed analysis will be required before selecting the right fund.

https://www.fidelity.com/learning-center/investment-products/etf/types-of-etfs-actively-managed

Got it! I have some ETFs in my portfolio but never really paid attention to the expense ratios because they seemed to be small percentages. But I can see for large investments and over the long term, how these small percentages can add up to big money. The quick comparison you showed is definitely helpful to compare different options.

Excellent! Till now we talked about fees that are specific to some funds or investments but one fee that is common to all funds or investments is taxes.

6. Taxes

These are also a type of fees that you pay when you sell your investments like stocks, ETFs, bonds, etc. The amount of taxes you pay depends on the type of account where the investments are held. There are broadly three types of accounts – Tax-deferred retirement accounts, Tax-exempt retirement accounts and Taxable brokerage accounts. [For a detailed description of these accounts and their implication on taxes during retirement, check out the blog – https://wealthwiseowl.com/the-three-types-of-accounts-you-will-need-during-retirement/] To give a quick summary on tax implications, for the tax-deferred accounts like the traditional 401k and traditional IRAs, you do not pay taxes on the dividends or growth of funds in the account but taxes need to be paid on the withdrawal amount under the ordinary income tax bracket. For the Roth 401k and Roth IRAs, which are the Tax-exempt accounts, there are no taxes to be paid on any amount you withdraw and here too the investments grow tax-free. There are certain criteria that need to be met like having the Roth account open for atleast 5 years to realize these tax benefits. The two types of accounts discussed above are also called tax-advantaged accounts because of the tax benefits they offer. However, the third type of account, taxable brokerage account, has no such benefits but is equally important for retirement planning and even for meeting short term financial goals. The profits realized on selling the investments in this account are taxed based on how long you held the investment. If you held the investment for more than a year before selling then the profits would be taxed at the long term capitals gain tax rate. However, if you sold the investment within one year of buying the investment then the gains are taxed at short term capital gains tax rate. You get rewarded for holding the investment longer since the long term capital gains tax rate are lower than the short term, which are actually equivalent to the ordinary income tax rate.The long term and short term captial gains tax rate for 2024 is given below.

LONG TERM CAPITAL GAINS TAX

| Filing Status | 0% | 15% | 20% |

| Single | Up to $47,025 | $47,026 to $518,900 | Over $518,900 |

| Head of household | Up to $63,000 | $63,001 to $551, 350 | Over $551,350 |

| Married filing jointly or surviving spouse | Up to $94,050 | $94,051 to $583,750 | Over $583,750 |

| Married filing separately | Up to $47,025 | $47,026 to $291,850 | Over |

SHORT TERM CAPITAL GAINS TAX

| 2024 Rate | Single Individual | Married Individuals Filing Jointly | Married Individuals Filing Separately | Head of Household |

| 10% | $11,600 or less | $23,200 or less | $11,600 or less | $16,550 or less |

| 12% | $11,600 to $47,150 | $23,200 to $94,300 | $11,600 to $47,150 | $16,550 to $63,100 |

| 22% | $47,150 to $100,525 | $94,300 to $201,050 | $47,150 to $100,525 | $63,100 to $100,500 |

| 24% | $100,525 to $191,950 | $201,050 to $383,900 | $100,525 to $191,950 | $100,500 to $191,950 |

| 32% | $191,950 to $243,725 | $383,900 to $487,450 | $191,950 to $243,725 | $191,950 to $243,700 |

| 35% | $243,725 to $609,350 | $487,450 to $731,200 | $242,725 to $365,600 | $243,700 to $609,350 |

| 37% | Over $609,350 | Over $731,200 | Over $365,600 | Over $609,350 |

It is easy to see the benefits of long term capital gains tax which ranges from 0 to 20% compared to the short term capital gains tax that ranges from 10 to 37%. The fact that you have the option of paying 0% taxes on long term capital gains is borderline unbelievable.

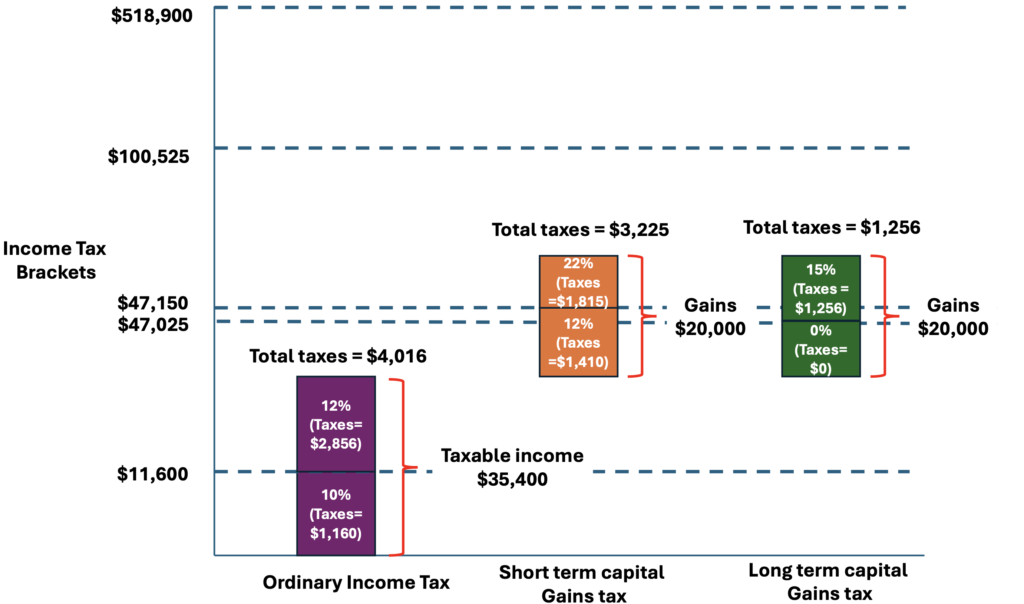

Let us take an example, where the adjusted gross income for an individual is $50,000. This is the annual gross income minus any deductions to the 401k, HSA, etc. If we assume a standard deduction $14,600, the taxable income is $35,400. Now let’s say this individual made some really good investments and sold some of them off for a profit of $20,000. The taxes this lucky person is going to pay on these profits will depend on how long the investments were held.So let’s look at two scenarios:

A) If the investments were only held for less than a year

The taxes on income that does not include profits will be based on the income tax brackets for ordinary income, which is also similar to the short term captial gains tax:

10% of 11,600 + 12% of (35,400 – 11,600) = $4,016

Now, since these investments were sold within a year, the profits will be subjected to short term capital gains tax i.e. be treated as ordinary income. Some of these profits will fill up the income bracket for 12% tax rate that is up to $47,150, and rest will be taxed in the 22% tax bracket. So, the short term captial gains tax will be

12% of (47,150 – 35,400) + 22% of (20,000 – (47,150 – 35,400)) = $3,225

It is easy to show the way the profits are taxed using the infographics below:

B) If the investments were held for more than a year

The taxes on the income that do not include the profits from selling the investments would remain the same at $4,016.

The only thing that will change in this scenario is the taxes on profits, which will be a long term capital gains tax. This is taxed in a different tax bracket from the ordinary income as shown in the table above. The profits till the income bracket up to 47,150 is filled is taxed at 0%. The rest of the profits will be taxed at 15% since the next income bracket is at $518,900.

0% of (47,150 – 35,400) + 15% of (20,000 – (47,150 – 35,400)) = $1,256

Comparing the two scenarios, you end up paying less than half in capital gains taxes and keep more of the profits to yourself if the investments are held for more than a year. The figure above shows the comparison of short term and long term capital gains taxes along with the tax bracket the profits/income fall under.

The only good thing about taxes is that you do not have to pay them on losses you incur from selling investments. For example, if the individual in the example also makes a loss of $10,000 on another investment in the same year, then the taxes will be paid on the net profit i.e. $20,000 – $10,000 = $10,000. If the individual makes a net loss then there will be no taxes that need to be paid and this loss can actually reduce the taxable income by upto an amount of $3,000 in a given year, while the remaining can be carried forward. It is important to note that the profit or loss on any investment is made only when the investment is sold off, which is also called as realized gains or losses.

Like always, taxes take the cake of being the most complicated with a lot of rules and caveats. But my takeaway is to always aim for holding onto investments for more than a year because there is a significant benefit of lower taxes that is hard to argue against. Thank you Wealth Wise Owl for all the information, which is all very practical fo me now since I am getting serious about investing. This time when I make profits, I will sure be proud of myself that I know exactly how much it is that I will get in hand.

Glad to be of help! Also, remember one more thing, do not forget to give me a nice treat when you are swimming in the green!