What is the number one thing you check before starting a project be it at home or at work? Let me not keep you guessing, the answer is the right tools to complete the project. Without the proper tools or resources at your disposal it is guaranteed that either the job will take longer to complete and worst case may not even complete. The same is true when we embark on the project to plan your retirement. Our first thought should be to gather all the resources that will support the much awaited retired life. I feel that financial accounts should be on the top of the resource list for retirement. These accounts will provide the means to enjoy the lifestyle you want to live after the hard grind of a working life. So, it is important to get to know more about them – who they are, what they behave like, how to use them – just like you would get to know your friends, especially when they will be with you till your last breath!

I will chat with the Wealth Wise Owl to get information about different accounts we should have during retirement. It is never too late or too early to start creating these accounts, so hopefully the conversation below will help you get started.

If you want to jump to the chat about some specific accounts please use the links below:

- Tax- deferred retirement accounts

- Tax-exempt or Tax-free retirement accounts

- Taxable brokerage accounts

Conversations with the Wealth Wise Owl

Hello my friend, looks like you have had a sumptuous lunch because I see a very satisfied grin on your face!

Hellooooo! You guessed it right! It is hard to hide the contentment from a delicious meal and part of the grin is also from seeing you again!

Hellooooo! You guessed it right! It is hard to hide the contentment from a delicious meal and part of the grin is also from seeing you again!

Yes, of course! It is these conversations that I look forward to with you and get tremendous joy from watching your amazement on some of the things I share.

Well, you can count on getting those reactions from me today because I am definitely going to learn something new today. I was wondering about what financial accounts I should start creating that would support my retirement plan?

That is a really good thing to wonder about because having the right accounts is equivalent to starting a race with the right car, which you can fuel up with your savings. This will guarantee that you cross the finish line in life with flying colors without the need to constantly check your dashboard.

Great analogy about the race because this would be the most important one as there is no option to get stuck in the middle and really do not want to manually push my car to the finishing line. So, how many and what types of accounts do I need?

There are three types of financial accounts and they are classified based on their implications on taxes.

- Tax-deferred retirement accounts

- Tax-free retirement accounts

- Taxable brokerage accounts

You may have heard the phrase by Benjamin Franklin that in this world there is nothing certain except for – death and taxes. Given taxes are a certainty no matter what, it makes sense that they govern how these accounts are classified as the name of the game during retirement would be to minimize paying taxes.

- Tax deferred retirement accounts

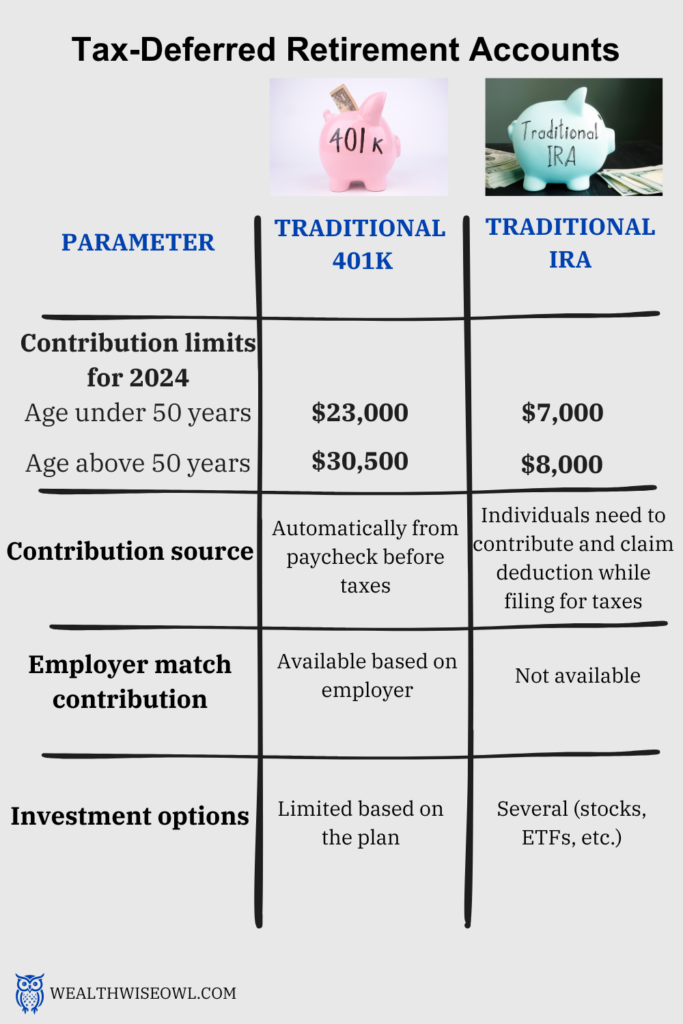

These accounts are the employer sponsored traditional 401k accounts, traditional IRAs (Individual Retirement Accounts), etc. where you do not have to pay taxes on your contributions to these accounts. But when you withdraw from these accounts after retirement age, then you have to pay taxes on the amount you withdraw. Basically, these withdrawals get treated as your ordinary income and you get assigned to a tax bracket based on how much you withdraw. “Save now and pay later” is the mantra for these accounts when it comes to taxes. The most popular accounts are traditional 401k accounts and traditional IRA accounts. [Check out the Ultimate Beginners Guide to 401k accounts]

The four key differences between these are

Resource: For more details on the tax deferred accounts please check out the following post

https://www.investopedia.com/ask/answers/12/401k.asp

PROS and CONS from a retirement perspective

Like everything in life there are both pros and cons of this retirement account. The biggest pro is that it helps you save on taxes now and these savings can be invested till the time you retire. The contributions here grow tax-free compared and even the dividends earned are not taxed, which is not possible in a taxable brokerage account. The biggest con is that you will have to pay taxes during retirement and based on history they have always increased over time so you might have to pay higher taxes in the future. However, if you current tax bracket is high and you might end up with a lower tax bracket during retirement then this will not be a con.

That’s interesting! I remember we talked about the 401k accounts before and you will be glad to know that I remember a lot from the last time we talked! I like the aspect of saving on taxes now because that means more money for investing for the long run. Curious to know what the tax-free retirement account is? “Free” is one of my favorite words to hear!

Well if you like free, you would love this one because this is tax-free. So, get ready for it, the account number 2 is

2. Tax – Free or Tax-Exempt retirement accounts

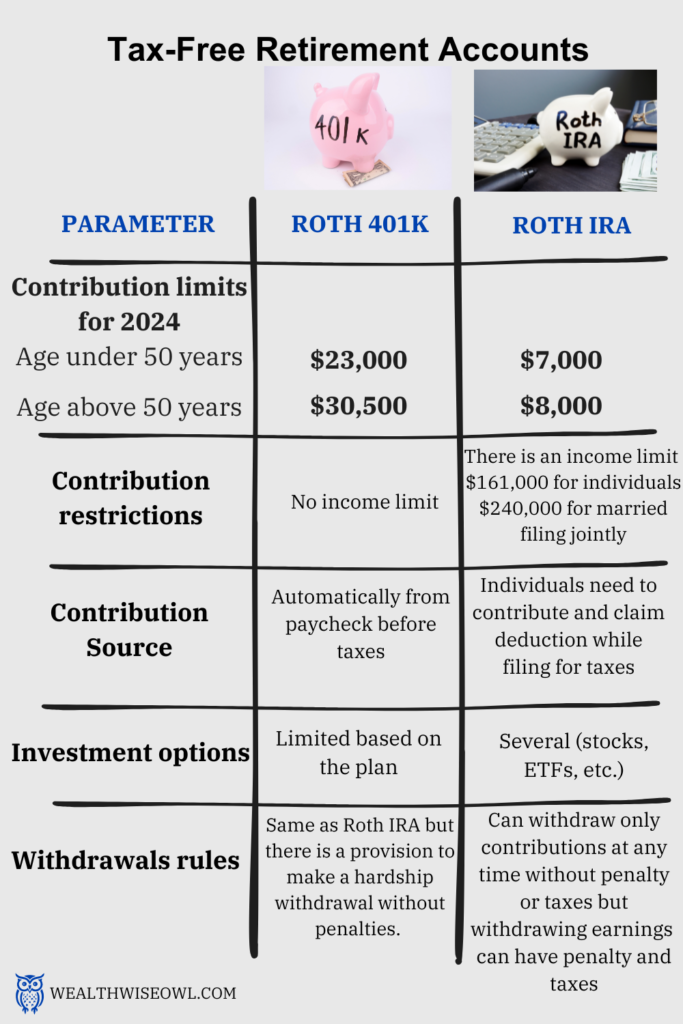

Just like the Tax-deferred accounts, these can be employer sponsored Roth 401k accounts, Roth IRAs, etc. [Check out the Ultimate Beginner’s Guide to 401k accounts] The beauty of these accounts is that you make contributions with after tax money and then you do not have to pay taxes or penalties on withdrawals as long as you meet certain criteria. So, the contributions here grow tax-free and also you have the option to withdraw tax-free, which is not possible in the tax-deferred accounts.

Some key differences between the Roth 401k and Roth IRA accounts are

PROS and CONS from a tax perspective

The important pro for this account is that you do not have to worry about paying taxes on any amount you withdraw from this account. So, you own all the money you have saved in this account and do not owe anything to Uncle Sam. The con of this account is you can only invest after-tax dollars into this account which means you do not get any tax savings upfront. These savings could have grown significantly till your retirement and in some cases compensated for the taxes you pay later.

Some resources on Tax-Free or Tax-Exempt retirement accounts

Resource: General differences between Roth 401k and Roth IRA accounts

https://www.investopedia.com/articles/personal-finance/063015/roth-401k-vs-roth-ira-one-better.asp

Resource: Roth 401k specific withdrawal rules

https://www.investopedia.com/ask/answers/101314/what-are-roth-401k-withdrawal-rules.asp

https://www.fidelity.com/learning-center/smart-money/roth-401k-vs-roth-ira

Resource: Roth IRA specific withdrawal rules

BONUS – Health Savings Account (HSA)

These accounts are triple-tax advantaged accounts that can fall under both tax-deferred and tax-exempt accounts. You need to be part of an HSA-eligible plan to contribute to HSA. The money you contribute to HSA reduces your taxable income and hence the taxes you need to pay. These contributions then grow tax-free and the withdrawals you make are also tax-exempt as long as you use that to pay for qualified medical expenses. Income tax will need to be paid on withdrawals from HSA for non-qualified medical expenses. Moreover, if you are below the age of 65 when you make withdrawal for non-qualified medical expenses then there is a 20% penalty along with income taxes. The 2024 contribution limit to HSA is $4,150 for individual health coverage and $8,300 for family coverage. At age 55, an additional $1000 can be contributed to HSA.

Resource: General HSA information

https://www.fidelity.com/learning-center/smart-money/what-is-an-hsa

Resource: Qualified medical expenses

You were right, I don’t just like this account, I love! Nice to know all the money in these tax-free accounts is mine and do not have to worry about paying taxes. The Health Savings Account also sounds too good to be true. Triple tax benefits with this account are amazing and I think this is the first thing I am going to open as soon as I get back. You said there is third type of account, what is that?

The third account is technically not a retirement account but has great value to your retirement planning.

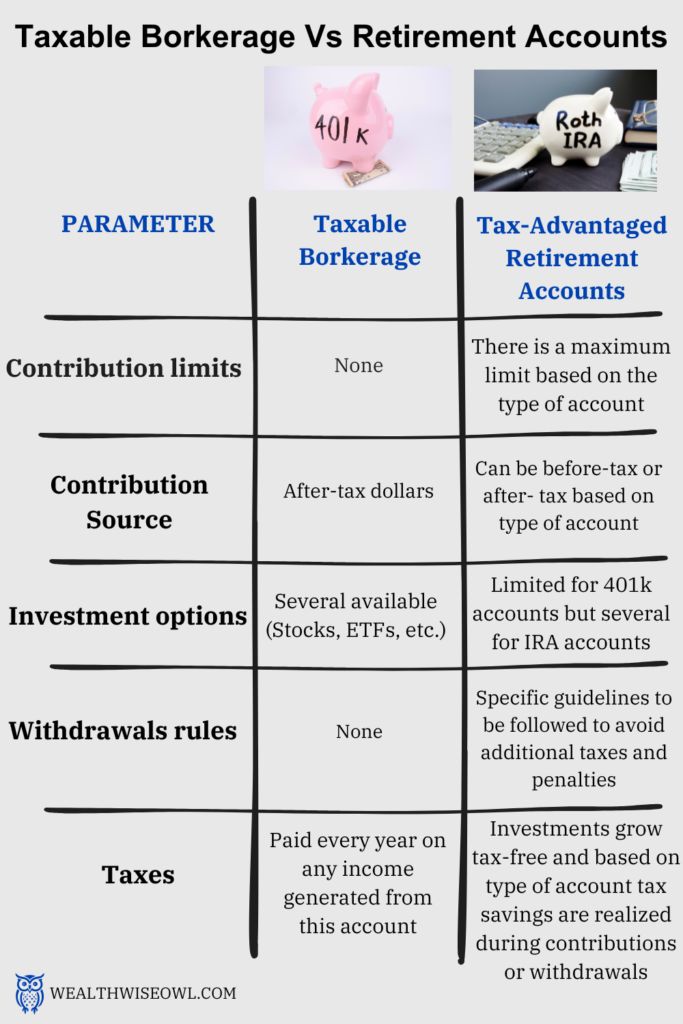

3. Taxable brokerage account

This account does not offer any of the tax advantages with tax-deferred or tax-exempt accounts. So, the best time to contribute to this account is after maxing out the contributions to the tax advantaged retirement accounts. You can open this account anytime and there are no contribution limits or withdrawal rules like the retirement accounts. There is also a lot of flexibility in terms of investment selections. However, you pay taxes on annual income from this account be it in the form of dividends, interest or gains from selling. The only tax advantage you can avail here is if your income qualifies for long term capital gains tax when selling an investment or falls under qualified dividends for dividend income. In these cases you will have to pay relatively lower taxes.

Capital gains – Profit made from selling an investment. For example if you buy a stock for $100 and sell it at $150, then $50 is the capital gains. You will pay taxes on this $50 and it will qualify as long-term capital gains if you hold the stock for more than a year, otherwise it will be a short-term capital gains (same as ordinary income). The taxes for long-term capital gains range from 0% to 20% based on your taxable income, whereas short-term capital gains taxes range from 10% to 37%.

Resource: Information on taxes for long-term and short-term gains

Dividends – This is the income you receive for owning a stock that company pays from its earnings. They are classified as qualified and non-qualified dividends for tax purposes. The qualified dividends are subject to long-term capital gains tax whereas non-qualified are subject to short-term capital gains tax. A qualified dividend is the one paid by an US corporation or an qualifying foreign entity and it is one paid for holding the stock for atleast 60 days in the 121 day period starting 60 days before the ex-dividend date. You do not usually have to do this complicated calculation to determine whether a divided is qualified because the financial institution where you hold the stock will do it for you and give a 1099-DIV tax form that tell you the amount of qualified dividends.

Resource: Information on types of dividends and taxes on them

Some key difference of these accounts from the tax advantaged i.e. tax-deferred and tax-exempt retirement accounts are

PROS and CONS from a retirement perspective

This account does not have any contribution or withdrawal rules, so gives a lot of flexibility in terms of investing as well as withdrawing the money any time you want. The biggest disadvantage is that you do not get any tax advantages from contributing to these accounts and hence no savings either before tax or after tax.

I see the flexibility this account gives compared to the tax-advantaged retirement accounts as a big positive. This account can be used to save for relatively short term goals and can tune my risk tolerance based on the goals. Overall, I am really pleased with all the information you gave me. This is a lot of good information! I am sure based on my intense expressions and aggressive note taking you must have realized how important this was for me to understand. The three different types of accounts have so much to offer and are very powerful because of the tax diversification options they offer to minimize paying taxes both before and after retirement. I can easily see that owning all these type of accounts will give me options to optimize my withdrawal strategy during retirement, did I understand that correctly?

You hit the nail in the head! This is exactly the reason why you should have all the three types of accounts because it allows you to strategize your withdrawals over the entire retirement period without paying too much in taxes. Keep in mind there are other factors that can affect your withdrawal strategy which we did not have time to talk about today. One is the social security benefits, which can increase your taxable income and it is important to properly time when to avail those benefits. Another important factor to consider is “Required Minimum Distributions (RMDs)” for tax-deferred accounts. This is the minimum amount you need to start withdrawing after age 73 because the government want to make sure it gets taxes from you before you take-off from earth permanently! Since this counts towards your taxable income and something that you will have to take to avoid penalties, it reduces your flexibility to meet your income needs from other accounts while minimizing the taxes. So, I should say that even though you can retire from work, you will never be able to retire from using excel spreadsheets and rigorous math. There are qualified financial advisors and tax professionals that can guide you through this but it is important to know these account basics to help prepare better.

Thank you my friend for sharing your wisdom and informing me about all the right tools needed to carve out my retirement journey. I need to go now and start opening some accounts, see you later!