It is that time of the year when you are looking to put your feet up and enjoy the holiday season. This is the time to be grateful for all the things you have achieved in the year and celebrating with friends and family. While you are doing all this, it is also important to review your finances and make sure you have achieved everything you had planned for and more. I like to look at my financial health at the end of the year and ensure that I have not missed out on any good opportunities to save money. Because any money saved is as good as money earned, it is part of my achievements and I feel good about it. In my research to create a list of things to look at for opportunities, I found some good tips that I would like to share. Let us talk to the Wealth Wise Owl to learn more. Please check out these useful YouTube videos for more information

9 Things to Do Before 2024 Ends

7 Things To Do Before 2024 Ends (Financially)

If you would like to jump to a particular topic, please use the links below:

Item 1: Create a list of Assets and Liabilities

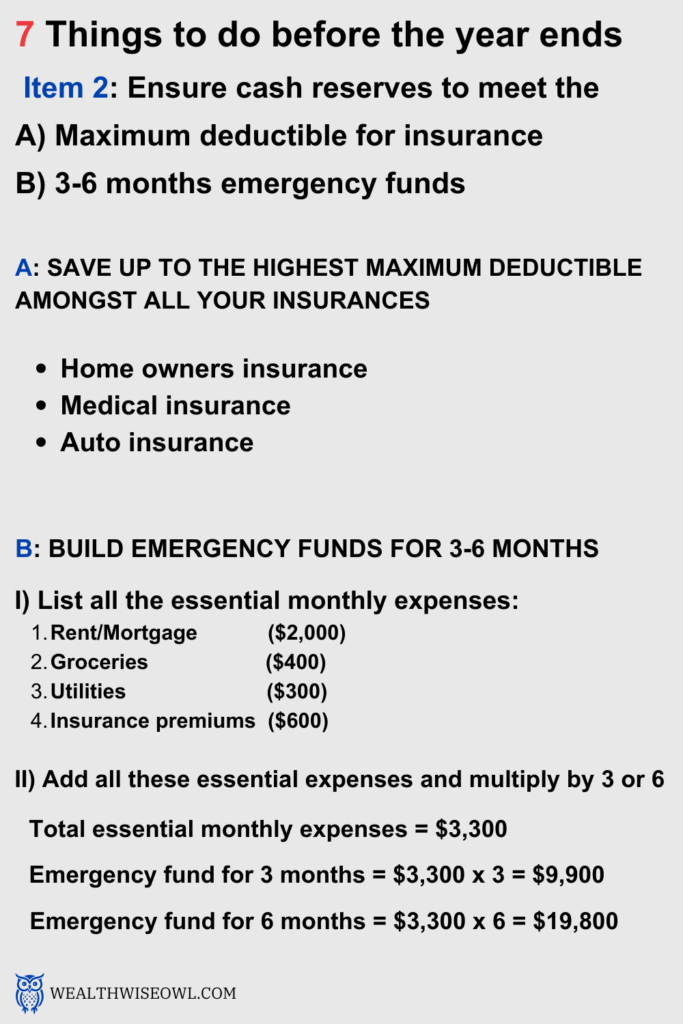

Item 2: Ensure cash reserves to meet maximum deductible for insurance and 3-6 months emergency funds

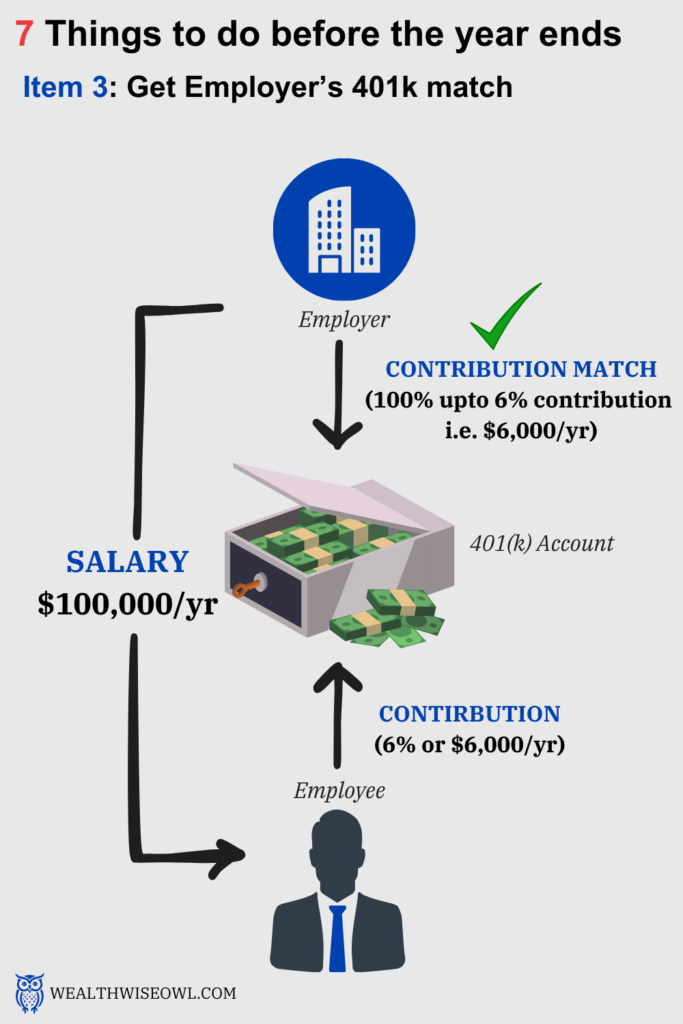

Item 3: Get Employer’s 401k match

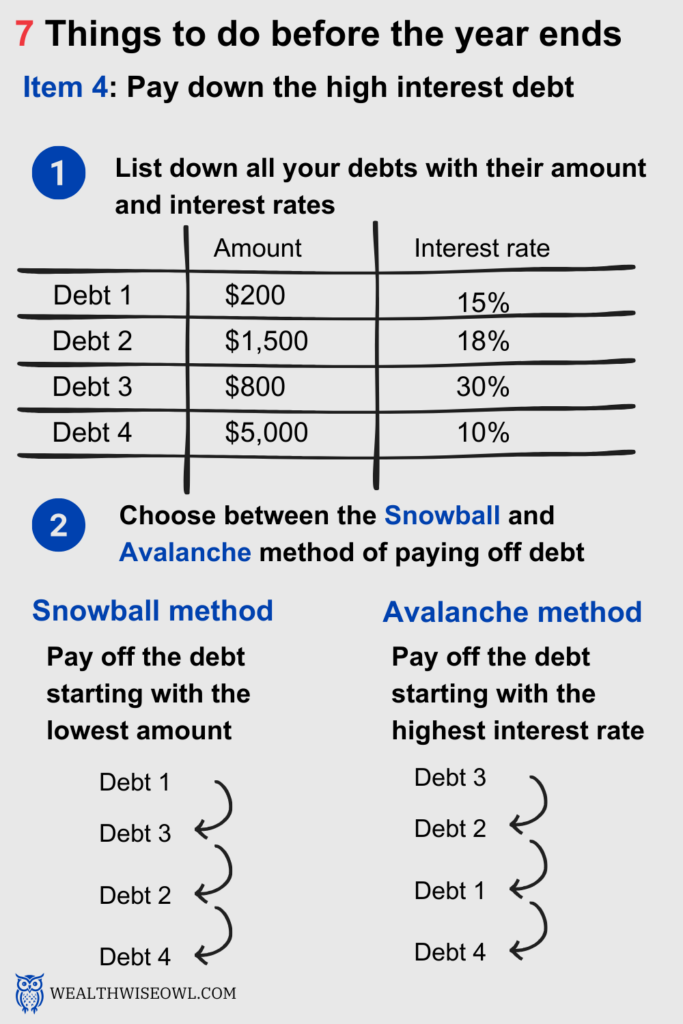

Item 4: Pay down high interest debt

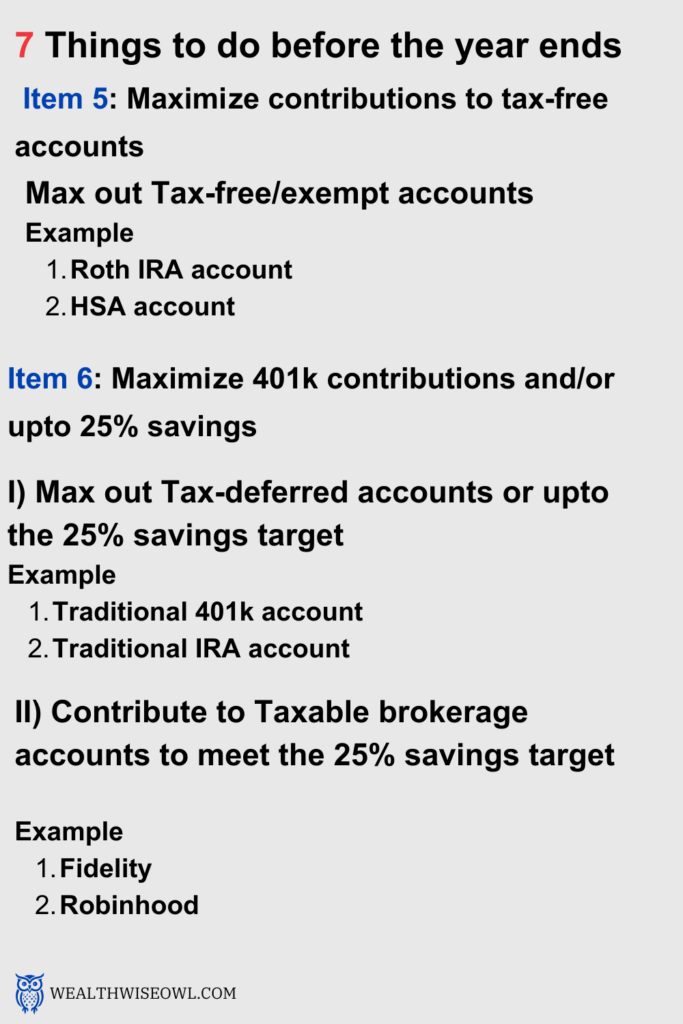

Item 5: Maximize contributions to tax-free retirement accounts

Item 6: Maximize contributions to tax-deferred accounts or upto 25% savings target

Item 7: Save for future goals and expenses

Conversations with Wealth Wise Owl

Happy Holidays!! The decorations you have put up are amazing!

Happy Holidays to you too! It is my favorite time of the year and I like to see colorful lighting and decorations all around. How are you celebrating the end of the year?

I have a few trips planned to visit my family and have some delicious food. I was also planning to review my finances and make sure that I have maximized my savings for the year. Since we talked a lot about ways to save on taxes and order of investing, it will be nice to go through a checklist on the things I can look at to make sure I did not miss anything.

That is a wonderful year end activity and highly recommend that you make this an annual tradition. We can definitely go through some of the things that you can do now to make the most of the opportunities.

Awesome! I would really appreciate that and like always I have my ears open and hands warmed up to take some notes.

Great! A lot of what you need to do comes from the Order of investing that we had talked about, so it will be good if you go through the notes you have from that conversation. [check out this blog on Order of investing]

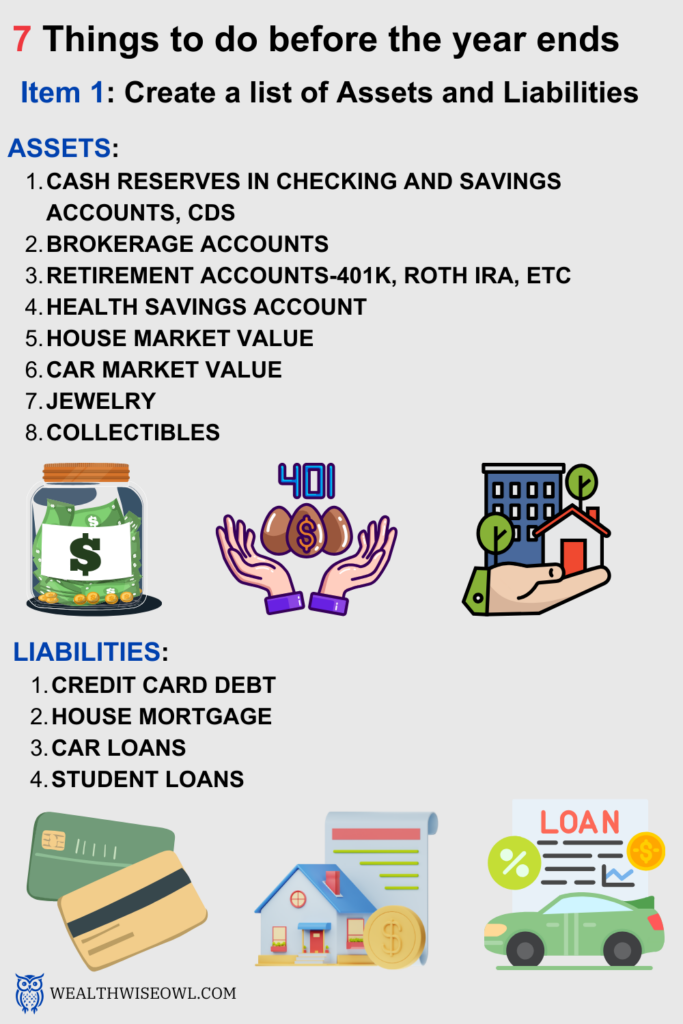

Item1: First thing that you can do is to write down all your assets and liabilities. To put simply assets are what you own and liabilities are what you owe. A list of common items that fall into these categories are shown below.

Assets: Retirement funds (401k, IRA, HSA), Brokerage account funds, Savings account and Checking out funds, Fixed income funds like CDs/money market funds, Equity in house, Physical gold, Collectibles, etc.

Liabilities: Credit card debt, House mortgage, Car loan, Student loan

Got it, I believe this will also help me to know what my net worth is, which is Assets – Liabilities if I remember my accounting 101 correctly. I can definitely see myself feeling proud if my assets are greater than my liabilities but if not I will have my work cut out for me to reduce my liabilities next year.

Yes, always remember that things are always work in progress so don’t stress too much if you are behind. The important thing is you are headed in the right direction. Once you have your assets and liabilities listed, you can proceed to item 2 on the checklist.

Item 2: Make sure that the total of money you have in savings, checking and other cash reserve funds can cover the highest insurance deductible and 3-6 months of living expenses (total of – rent, utilities, insurance premiums, groceries). The idea is to have liquid cash for use in emergencies. It is preferable that you have these cash reserves in accounts that earn you a higher interest rate than the regular checking account.

Okay, I will make sure that I have enough liquid cash in a high yield savings account that can cover my highest deductible and at least 3 months of living expenses. I have started putting some money in a savings account this year but need to check where I am at.

That’s great, this will give you the peace of mind in case of emergencies that would require your insurance to kick in and give you time to look for another job without worrying about covering your living expenses. Item 3 is a great one because it is about free money!

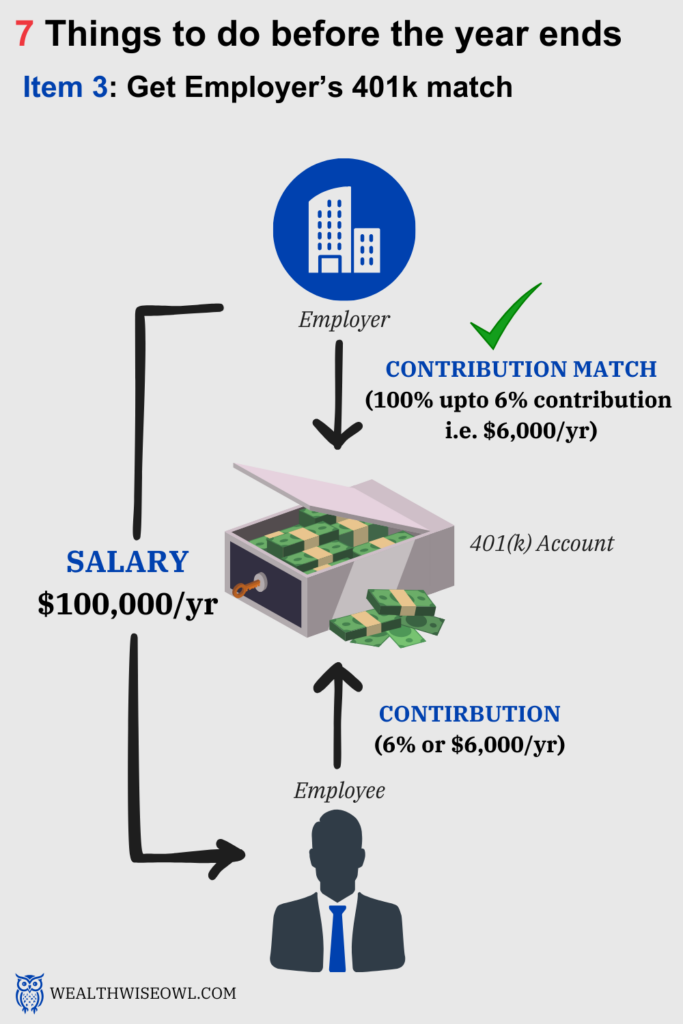

Item 3: Get the employer’s 401k match if you have one. This is basically free money so it is a no-brainer to make sure you have contributed enough to your 401k that you get the maximum employer match. Most employer’s would match either a 100% or 50% of your contribution to the 401k and there is a limit on the percentage contribution that they will match. For example, they could have a 100% match to a contribution of up to 6% of your annual salary. This means that if your gross salary is $100,000/yr and you contribute 6% of your salary to 401k, i.e. $6,000, then the employer will also contribute $6,000 to your 401k. [For more details on 401k accounts and employer match check out this blog] Therefore, in this example, you should make sure that you have contributed at least 6% of your salary to 401k to get the maximum employer match.

I already started doing this after our conversation on the order of investing. It was amazing that I was not taking the full advantage of this employer match till very recently.

I am glad you are already doing that. It seems too good to be true but something that is very useful towards building your retirement fund. The next thing you can look at is bringing down your debt. It is hard to avoid debt because you need the money at a stage in life where you are either not earning or do not have enough saved up. It is good to have just the good debt which could be like a student loan or house mortgage and try to avoid the bad debt which is all about the credit cards.

Item 4: From the list of debts you created in Item 1, list them in a decreasing order of interest rates on those debts. If you have excess money left at the end of the year or there is a year end bonus, then after meeting requirements of Items 2 and 3, use that money to pay down the debt with the highest interest rate. Usually this highest interest debt would be credit card debt. [For more details on what qualifies as high interest debt check out this blog]

Yes, I try to keep my credit card debt low but there is a lot of spending around the holiday season so I will need to keep that in check.

Again, even if you do not get rid of all the debt this year it is fine. Just make sure that you are chipping away at it. If you are able to get rid of the high interest debt, then in Item 5 of your checking, you can focus back on the retirement accounts, especially the tax-free accounts.

Item 5: Maximize your contributions to Roth IRA and, if applicable, HSA. These are your retirement accounts which allow for tax-free growth of your investments, which feels too good to be true. But they have relatively lower contribution limits, compared to the tax-deferred retirement accounts, so it is best to make the most of it by contributing up to these maximum limits. [For more details on tax-free or tax-exempt retirement accounts check out this blog] Since there is open enrollment for health benefit plans towards the end of the year, it is important to check if a HSA is beneficial to you since it is only eligible for a high deductible insurance plan. So, based on any upcoming life events like having a baby or your medical needs, compare which health insurance plan works best for you.

I do have both the IRA and HSA accounts open but I do not think I have been able to maximize my contributions to them. I will check if there is scope in my budget to increase my contributions to these accounts after I have paid down the debt.

Amazing! You will be rewarded with tax-free money when you retire and then you can pat yourself on the back for making these smart choices early in life. Item 6 on the checklist is also related to your retirement account but this one is tax-deferred. It will help you save on your taxes now and then pay them after you retire.

Item 6: Maximize your contributions to your 401k account or at least till you get to 25% savings rate. Contributions to your 401k reduce your taxable income and will reduce your tax bill, which is also a form of savings. If you are in a high income tax bracket, greater than 30% marginal tax bracket (federal,state and local combined), it is highly recommended to maximize these contributions. [For details on how to calculate the marginal tax rate, check out this blog] One thing to keep in mind is that you can stop at lower than the maximum contribution limit if you have hit the 25% savings rate. You can go ahead and still contribute to the max limits but it is more a choice than a requirement. If you have already hit the 25% savings rate then you can choose to contribute any excess money to future expenses like buying a car, paying for your children’s education, vacation, etc.

The 25% savings rate includes:

Employer sponsored retirement account, including employer match

Roth IRA and HSA

Pension contributions

Taxable brokerage account [if this is for retirement]

I am curious to know what my current savings rate is, so this will be a good exercise to get that number after going through these checklist items. I am positive my savings rate is not as high as 25% but that is the number I will work towards gradually.

Yes, slow and steady wins the race and, in the context of finances, ends up wealthy! The last item on the checklist is the fun one where you can reward yourself for all the good work of complying with the order of investing and finishing the 6 items of the checklist.

Item 7: After you have checked off all the 6 items, you can start to plan for saving towards your life goals which can be a vacation, a house, an expensive car, paying for your kids education, etc. You could also choose to pay down your low interest debt like your house mortgage. This would make sense if you prioritize living debt free and not have the burden of making those monthly payments.

Thank you Wealth Wise Owl! This has been a tremendous help talking about things I need to complete before the end of the year. I will get started on this checklist and hopefully I can get it completed before Christmas because I do not want finances on my mind when I am opening presents! See you soon!